What Were Schlumberger’s Drivers in 2Q17?

In 2Q17, Schlumberger reported a net loss of ~$74 million—a sharp improvement compared to 2Q16 when it reported a net loss of $2.16 billion.

Nov. 20 2020, Updated 1:05 p.m. ET

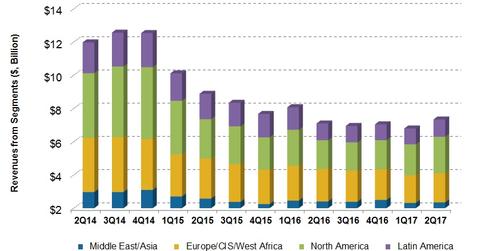

Revenue by geography

Schlumberger’s (SLB) Europe, CIS (Commonwealth of Independent States), and West Africa region’s revenues fell 10% in 2Q17—compared to 2Q16. It was the highest revenue fall. The Middle East and Asia region fell 2%. Schlumberger’s revenues from North America staged a remarkable comeback and rose 27% from 2Q16 to 2Q17. Schlumberger accounts for ~6.0% of the ProShares Ultra Oil & Gas ETF (DIG). DIG has fallen 22% in the past year—compared to a 21% fall in Schlumberger’s stock price.

Operating margin

Reservoir Characterization, Production, Drilling, and Cameron are Schlumberger’s four product groups. Schlumberger’s Reservoir Characterization group’s 2Q17 operating income margin remained unchanged at 17%—compared to the previous year. The Production group’s operating margin improved to 9% in 2Q17 from 4% in 2Q16. The Drilling group’s operating margin rose to 14% in 2Q17 from 8% in 2Q16.

Negative drivers

- pricing pressure in the Gulf of Mexico caused lower offshore revenue

- less rig-related work in Western Canada due to the spring breakup

- weak upstream activity in Brazil and Venezuela

- lower revenue from Kuwait

- decreased revenue from India as the monsoon had a negative impact on rig activity

Positive drivers

- strong fracking activity and a higher rig count led to accelerated completion activity in North America

- better pricing for Schlumberger’s products and services

- change in rig design and longer laterals led to higher demand for Schlumberger’s rotary steerable systems and drill bit technologies

- strong performance in Mexico, Russia, and the CIS regions

- increased upstream activity in the North Sea in Europe

What impacted Schlumberger’s 2Q17 earnings?

In 2Q17, Schlumberger reported a net loss of ~$74 million—a sharp improvement compared to 2Q16 when Schlumberger reported a net loss of $2.16 billion due to huge impairment and restructuring charges. In 1Q17, Schlumberger recorded net income of $279 million. It’s reported earnings fell in 2Q17.

Net loss for Schlumberger’s peers

In comparison, TechnipFMC’s (FTI) reported net income was ~$159 million in 2Q17. In 2Q17, Fairmount Santrol Holdings’ (FMSA) net income was $10.5 million, while Weatherford International’s (WFT) net loss was $165 million. To learn more, read Fairmount Santrol Holdings’ 2Q17 Earnings Beat Estimates.

How much does Schlumberger depend on North America? We’ll discuss this in the next part.