Esbriet Could Boost Roche’s Revenue Growth in 2H17

In the first half of 2017, Roche’s (RHHBY) Esbriet reported revenues of CHF 418.0 million, which reflected a ~16.0% growth on a YoY basis.

Sept. 21 2017, Updated 4:06 p.m. ET

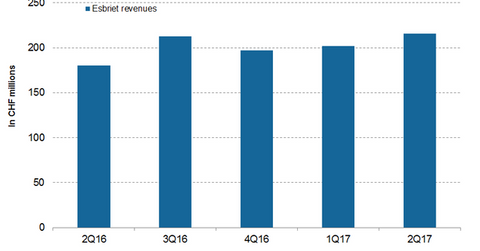

Esbriet revenue trends

In the first half of 2017, Roche’s (RHHBY) Esbriet reported revenues of CHF[1. Swiss franc] 418.0 million, which reflected a ~16.0% growth on a YoY (year-over-year) basis. In that period in the US market, Esbriet generated revenues of CHF 314.0 million, which is a 19.0% rise on a YoY basis.

In 2Q17, Esbriet generated revenues of CHF 180.0 million, which reflected a ~20.0% rise on a YoY basis and a ~7.0% rise on a QoQ (quarter-over-quarter) basis. In 2Q17 in the US and European markets, Esbriet generated revenues of CHF 161.0 million and CHF 46.0 million, respectively, which reflected ~20.0% and ~13.0% rises YoY, respectively. Increasing market penetration into moderate and mild patient segments primarily attributed to the revenue growth of Esbreit in 2Q17.

The chart above demonstrates the revenue curve of Esbriet from 2Q16 to 2Q17.

About Esbriet

Esbriet (pirfenidone) is used for the treatment of idiopathic pulmonary fibrosis (or IPF).

In June 2017, the EC (European Commission) approved Esbriet’s new tablet formulation for the treatment of individuals with mild to moderate IPF. Esbriet’s new 801 mg (milligram) tablet will reduce the pill burden. Now IPF patients can take one tablet three times per day compared to the previous dose of three capsules three times a day. The approval of the new tablet also boosted the drug’s revenue growth in 2Q17.

In September 2017, Roche presented the results of the six-month trial of Esbriet and nintedanib combination therapy in individuals with IPF. The study demonstrated that Esbriet and nintedanib combination therapy had a similar safety profile compared to each therapy alone.

Currently in the United States and Europe, around 100,000 individuals and 110,000 individuals, respectively, have IPF, which indicates a large patient pool around the world.

Esbriet competes with Boehringer Ingelheim’s Ofev in the IPF drugs market. Roche’s peers who are researching IPF drugs include Bristol-Myers Squibb (BMY), FibroGen (FGEN), Promedior, and others. The Vanguard International Dividend Appreciation Index ETF (VIGI) invests ~2.9% of its total portfolio holdings in Roche Holding. VIGI also invests ~2.5% of its total portfolio in Sanofi (SNY).