Improving Economies Make Strong Case for EM Local Debt

As the emerging market local debt assets (EBND) (ELD) continue to evolve and expand, investors are increasingly looking for opportunities in the space to enhance returns.

Sept. 28 2017, Updated 4:36 p.m. ET

VanEck

The changes in the Index over the past five years reflect the broader evolution in the emerging markets local debt market. Over the past several decades, many emerging markets countries have increasingly sought to develop their local currency bond markets. This helps reduce their vulnerability to external shocks which could impact their ability to repay U.S. dollar-denominated debt. Uruguay is the latest example of this long-term trend away from a reliance on external debt. More countries are expected to be added to the Index over the coming years, most notably China. As the market continues to grow, we expect emerging markets local debt to play an increasingly large role within global bond portfolios.

Market Realist

Emerging markets have witnessed improvement in their fundamentals

As the emerging market local debt assets (EBND) (ELD) continue to evolve and expand, investors are increasingly looking for opportunities in the space to enhance returns. The key reason investors are turning towards local debt is the improving economic fundamentals across emerging markets. Many EMs have shown improvement in their important economic parameters like external reserves, current account deficits, and fiscal accounts while reducing their dollar liabilities. Importantly, currency depreciation in most of them appears to have stabilized. Countries like Brazil, Argentina, Uruguay, and Indonesia have initiated market-oriented reforms while maintaining sound monetary and business policies.

Substantial institutional ownership

A substantial portion of EM local bonds (LEMB) (EMLC) are held by large domestic institutions like pension funds and insurance companies. These institutions generally take a long-term investment view, thus providing relative stability to the market compared to foreign holdings, which could cause higher volatility during market uncertainty.

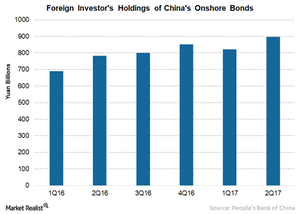

More additions

The JPMorgan GBI-EM Global Core Index is likely to see additions of a few more countries next year. China, Egypt, Sri Lanka, Serbia, and the Dominican Republic are the probable candidates. The inclusion of these five countries, especially China, will make the EM local debt much more liquid, larger, and deeper. The Chinese bond market is the third largest in the world with a size of $9 trillion. However, the EM local debt (FEMB) still plays a small role in the global bond market, which is set to change with the inclusion of new countries in the index over the next few years.