How Hewlett Packard Enterprise Is Increasing Shareholder Value

By the end of fiscal 3Q17, HPE had returned $107 million to shareholders in the form of dividends and $625 million through share repurchases.

Nov. 20 2020, Updated 11:56 a.m. ET

HPE’s dividends and share buybacks

Hewlett Packard Enterprise (HPE) shareholders benefit from dividends and stock repurchases. By the end of fiscal 3Q17 (ended July 2017), HPE had returned $107 million to shareholders in the form of dividends and $625 million through share repurchases.

Since the start of calendar 2017, HPE has returned $2.3 billion to shareholders and is on track to achieve its target of $3 billion for the year.

HPE has a dividend yield of 1.9%, while technology peers (QQQ) Cisco Systems (CSCO), IBM (IBM), and NetApp (NTAP) have dividend yields of 3.7%, 4.2%, and 2.0%, respectively.

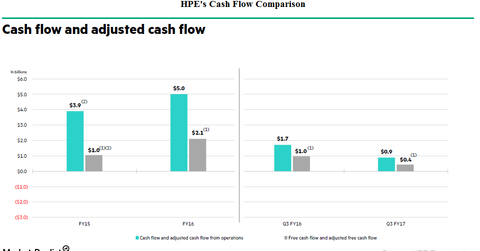

Cash flow

At the end of fiscal 3Q17, HPE’s free cash flow was $428 million, which was better than expected and driven by improvements in working capital management and favorable capital expenditures. The firm’s YTD (year-to-date) free cash flow at the end of fiscal 3Q17 was close to its full-year target.

HPE CFO (chief financial officer) Tom Stonesifer stated the following: “However, Q4 cash flow will likely be lower than in prior years due to less seasonal earnings uplift following the software, and ES divestitures and the additional restructuring charges were accelerating from fiscal year 2018.”

This means that HPE is maintaining its free cash flow target of -$1.8 billion for fiscal 2017, with some potential upsides. HPE expects cost savings between $200 million and $300 million in the second half of fiscal 2017, which is expected to improve profit margins.