Asian Markets Are Stable on September 1

On September 1, 2017, the Shanghai Composite Index rose 0.19% and ended at 3,367.12. The SPDR S&P China ETF (GXC) rose 0.32% and closed at 100.65.

Sept. 1 2017, Published 8:39 a.m. ET

Economic calendar

8:30 AM EST – US average hourly earnings (August)

8:30 AM EST – US non-farm payrolls (August)

8:30 AM EST – US participation rate (August)

8:30 AM EST – US unemployment rate (August)

10:00 AM EST – US ISM manufacturing PMI (purchasing managers’ index) (August)

10:00 AM EST – US Michigan consumer sentiment (August)

1:00 PM EST – Baker Hughes’s oil rig count

China

After rising for two consecutive trading weeks, China’s Shanghai Composite Index continued to rise and recorded the third consecutive weekly gain. The Shanghai Composite Index had a strong start this week and rose to new 20-month high price levels. As the week progressed, the market lost upward momentum and consolidated for the other four trading days.

The market opened higher on Friday following US markets’ strong performance on August 31. The stronger-than-expected Caixin manufacturing data also helped the Shanghai Composite Index open higher. According to data released by Markit, China’s Caixin manufacturing PMI was 51.6 in August—higher than analysts’ forecast of 50.9. A manufacturing PMI reading above 50 indicates an expansion in manufacturing activity. The market is looking forward to the release of Caixin services PMI data at 9:45 PM EST on September 4.

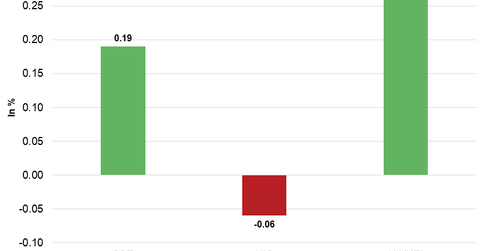

On September 1, 2017, the Shanghai Composite Index rose 0.19% and ended at 3,367.12. The SPDR S&P China ETF (GXC) rose 0.32% and closed at 100.65.

Hong Kong

Hong Kong’s Hang Seng Index regained strength last week and started this week on a mixed note. The market fell in three out of five trading days this week amid geopolitical tensions. The market closed the week flat. The Hang Seng Index broke the important resistance level 28,000 this week—the first time since 2015. However, amid the weak market risk appetite and profit-booking, the Hang Seng Index didn’t close the week above 28,000. Despite a strong opening following Wall Street’s gains, the Hang Seng Index closed almost flat on Friday. The market is waiting for the manufacturing PMI data that will be released on September 4.

On September 1, the Hang Seng Index fell 0.06% and closed the day at 27,953.16. On August 31, the iShares MSCI Hong Kong Index (EWH) rose 0.78% and closed at 24.69.

Japan

Following six consecutive weekly losses, Japan’s Nikkei Index started this week on a weaker note. Despite falling in the first two trading days, the Nikkei Index regained strength as the week progressed amid the improved market sentiment. Amid US markets’ strong performance, the Nikkei Index started Friday higher and closed the week with gains. On the economic data front, Japan’s manufacturing PMI fell to 52.2—below analysts’ forecast of 52.8. The Nikkei Index closed the day at 19,702.00—a gain of 0.28%. The iShares MSCI Japan Index (EWJ) rose 0.79% to 54.74 on August 31.

In the next part of this series, we’ll see how European markets performed in the morning session on September 1, 2017.