Asian Markets Are Mixed on September 19, Decreased Risk Appetite

On September 19, 2017, the Shanghai Composite Index fell 0.18% and ended at 3,356.84. The SPDR S&P China ETF (GXC) rose 1.1% and closed at 104.38.

Sept. 19 2017, Published 8:46 a.m. ET

Economic calendar

8:30 AM EST – US building permits (August)

8:30 AM EST – US current account (Q2)

8:30 AM EST – US housing starts (August)

10:30 AM EST – President Trump speaks

4:35 PM EST – US API weekly crude oil stock

7:50 PM EST – Japan’s trade balance, exports, and imports (August)

China

After losing upward momentum last week, China’s Shanghai Composite Index started this week on a stable note. The Shanghai Composite gained on Monday amid China’s stronger-than-expected new loans data. The upward movement was limited amid mixed market data released this month.

The weaker-than-expected fixed asset management data, retail sales, and industrial production triggered concerns about China’s economic outlook. Even though upbeat new loans data calmed the market’s concerns to some extent, the market sentiment is still mixed this week. The market’s risk appetite is low before the Fed’s interest rate meeting this week.

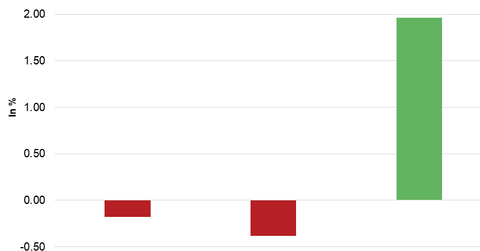

On September 19, 2017, the Shanghai Composite Index fell 0.18% and ended at 3,356.84. The SPDR S&P China ETF (GXC) rose 1.1% and closed at 104.38.

Hong Kong

After regaining strength at the end of last week, Hong Kong’s Hang Seng Index maintained its strength this week. The Hang Seng Index opened the week strong. It rose to the highest levels in 27 months in response to China’s strong new loans data and strength on Wall Street. Despite Wall Street’s strong performance overnight, the Hang Seng Index pulled back on September 19 due to profit-booking before the Fed’s interest rate meeting.

The Hang Seng Index fell 0.38% and closed the day at 28,051.41. On September 18, the iShares MSCI Hong Kong Index (EWH) rose 0.8% and closed at 25.06.

Japan

After rising last week, Japan’s Nikkei Index started this week on a stronger note. The markets were closed on Monday due to the “Respect for the Aged Day.” As a result, September 19 is the first trading day of the week. The yen’s decreased momentum, less geopolitical tension, and Wall Street’s strong performance on Monday boosted the market sentiment in Japan. Speculations about a snap election also supported the Nikkei and pushed it to two-year high price levels on Tuesday.

The Nikkei Index closed the day at 20,299.38—a rise of 2%. The iShares MSCI Japan Index (EWJ) rose 0.02% to 55.25 on September 18.

In the next part, we’ll see how European markets performed in the morning session on September 19, 2017.