Asian Markets Are Mixed amid North Korea Tensions

On September 15, 2017, the Shanghai Composite Index fell 0.53% and ended at 3,353.62. The SPDR S&P China ETF (GXC) fell 0.1% and closed at 102.65.

Sept. 15 2017, Published 9:57 a.m. ET

Economic calendar

8:30 AM EST – US core retail sales (August)

8:30 AM EST – U.S. NY Empire State Manufacturing Index (September)

8:30 AM EST – US industrial production (August)

10:00 AM EST – US business inventories (July)

10:00 AM EST – U.S. Michigan Consumer Sentiment (September)

China

China’s Shanghai Composite lost momentum last week amid geopolitical concerns. With bearish factors calming down, the market started this week on a stronger note and rose in the first three trading days.

However, the market lost its strength on Thursday and carried the weakness to Friday amid China’s weaker-than-expected economic data. The weaker-than-expected fixed asset investment, industrial production, and retail sales data took the shine out of the market. In 1H17, China’s market performance and strong corporate earnings increased market outlook in 2H17. Soft economic data this month impacted the market. The market also struggled to rise in the early hours amid North Korea’s missile launch over Japan.

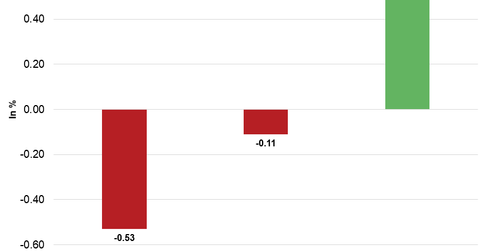

On September 15, 2017, the Shanghai Composite Index fell 0.53% and ended at 3,353.62. The SPDR S&P China ETF (GXC) fell 0.1% and closed at 102.65.

Hong Kong

Hong Kong’s Hang Seng Index started this week on a stronger note along with other global markets amid improved global market sentiment. However, the market lost strength in the middle of the week due to China’s weak economic data. The Hang Seng Index started lower on Friday amid North Korea’s missile launch over Japan. Wall Street’s overnight gains supported the market. The Hang Seng Index regained strength. The market was less concerned about North Korea’s missile launch as the day progressed.

On September 15, the Hang Seng Index fell 0.11% and closed the day at 27,807.59. On September 14, the iShares MSCI Hong Kong Index (EWH) fell 0.32% and closed at 24.75.

Japan

After briefly pulling back on Thursday, Japan’s Nikkei Index started lower on Friday but regained strength as the day progressed. Initially, North Korea’s missile launch over Japan made the market open lower. The demand for exporters amid a strong dollar and overnight gains on Wall Street supported the market and pushed the Nikkei to five-week high price levels. The Nikkei Index closed the day at 19,909.50—a gain of 0.52%. The iShares MSCI Japan Index (EWJ) rose 0.02% to 55.16 on September 14.

In the next part, we’ll see how European markets performed in the morning session on September 15, 2017.