Asian Markets Lost Strength amid North Korea Tensions

On Tuesday, the Shanghai Composite started the day on a weaker note by opening lower. However, the market gained strength as the day progressed.

Sept. 6 2017, Published 8:21 a.m. ET

Economic calendar

8:30 AM EST – US trade balance (July)

9:45 AM EST – US Markit composite PMI (purchasing managers’ index) (August)

9:45 AM EST – US services PMI (August)

10:00 AM EST – US ISM non-manufacturing employment (August)

10:00 AM EST – US ISM non-manufacturing PMI (August)

China

China’s Shanghai Composite Index gained for three consecutive trading weeks and reached fresh 20-year high price levels. It started this week on a stronger note on Monday and maintained stability at elevated levels.

On Tuesday, the Shanghai Composite started the day on a weaker note by opening lower. However, the market gained strength as the day progressed and closed the day flat. The weaker global market sentiment amid North Korea jitters caused the Shanghai Composite to start the day lower. Increased expectations about steps by the Chinese government to stabilize the economy supported the market on Wednesday. Hopes about the government’s plans to restructure underperforming state enterprises increased the risk appetite in Chinese markets. The upbeat Caixin services PMI data, released at the beginning of the week, also supported the sentiment.

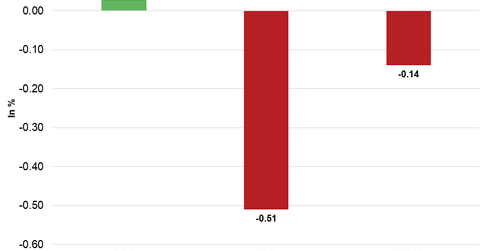

On September 6, 2017, the Shanghai Composite Index rose 0.03% and ended at 3,385.39. The SPDR S&P China ETF (GXC) fell 1.3% and closed at 99.61.

Hong Kong

After rising for eight consecutive trading months, Hong Kong’s Hang Seng Index started this month on a mixed note. It started this week lower amid increased geopolitical tensions. The index traded with weakness in the first three trading days. On Wednesday, it opened lower following weakness on Wall Street. The index recovered some of the losses as the day progressed. On September 6, the Hang Seng Index fell 0.51% and closed the day at 27,599. On September 5, the iShares MSCI Hong Kong Index (EWH) fell 0.97% and closed at 24.6.

Japan

Japan’s Nikkei Index regained strength last week and broke its six-week losing streak. Despite a brief rebound last week, the Nikkei Index is weak and started this week with negative sentiment amid North Korea tensions. The stronger yen and decreased risk appetite dragged the Nikkei Index to fresh four-month low price levels today. The market is looking forward to the release of Japan’s second quarter GDP on September 7.

The Nikkei Index closed the day at 19,357.97—a fall of 0.14%. The iShares MSCI Japan Index (EWJ) fell 0.44% to 54.25 on September 5.

In the next part of this series, we’ll see how European markets performed in the morning session on September 6, 2017.