Why Papa John’s Earnings Margin Narrowed in 2Q17

Performance in 2Q17 In 2Q17, Papa John’s International (PZZA) posted EBIT (earnings before interest and tax) of $37.2 million, which represents an EBIT margin of 8.6%. In comparison, the company posted an EBIT margin of 8.7% in 2Q16. Why Papa John’s margins narrowed Papa John’s EBIT margins were impacted by a rise in the cost of […]

Dec. 4 2020, Updated 10:52 a.m. ET

Performance in 2Q17

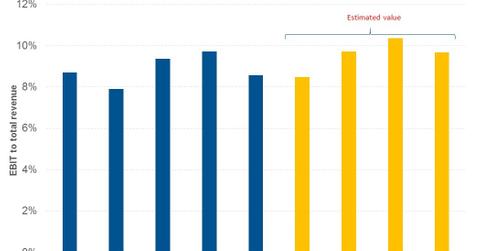

In 2Q17, Papa John’s International (PZZA) posted EBIT (earnings before interest and tax) of $37.2 million, which represents an EBIT margin of 8.6%. In comparison, the company posted an EBIT margin of 8.7% in 2Q16.

Why Papa John’s margins narrowed

Papa John’s EBIT margins were impacted by a rise in the cost of sales and higher D&A (depreciation and amortization) expenses. During the quarter, the cost of sales of domestic company-owned restaurants rose by 0.1% to 80.1% due to a rise in commodity prices and an increase in reimbursement expenses due to higher fuel prices. However, some of the increase in expenses was offset by lower advertising costs.

The North America commissary segment’s cost of sales rose by 0.7% to 93%. The new quality control center in Georgia, which is expected to open in 3Q17, increased the segment’s expenses. However, some of the expenses were offset by improved margins from the online business. For international operations, the cost of sales rose by 2% to 64.4% due to higher commodity prices in the United Kingdom that were not fully passed on to franchised restaurants.

During the quarter, G&A (general and administrative) expenses fell from 10.1% of total revenue to 9.7% due to lower management incentive expenses, supervisor bonuses, and a decrease in bad debts. However, some of the declines were offset by an increase in legal and professional fees.

Peer comparison and outlook

During the same period, Domino’s Pizza (DPZ) posted an EBIT margin of 18.0%, while Yum! Brands (YUM) is expected to post an EBIT margin of 28.2%.

For the next four quarters, analysts expect Papa John’s to post EBIT margins of 9.6%, compared with 8.9% in the four quarters prior. Next, we’ll look at Papa John’s 2Q17 earnings per share.