Inside Analysts’ Recommendations on United Parcel Service

Of the 27 analysts covering United Parcel Service (UPS), six analysts (22%) have a “strong buy” recommendation on the stock.

Aug. 30 2018, Updated 2:09 p.m. ET

Analysts’ recommendations

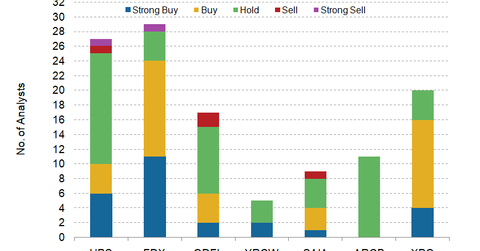

Of the 27 analysts covering United Parcel Service (UPS), six analysts (22%) have a “strong buy” recommendation on the stock. Four analysts recommend a “buy,” and 15 analysts (56%) have a “hold” recommendation. One analyst each has a “sell” and “strong sell” recommendation on UPS stock.

Analysts’ target price for UPS and its peers

Analysts polled by Thomson Reuters have set a consensus 12-month target price of $127.38 on United Parcel Service stock. Based on UPS’s last closing price of $123.87 on August 27, this reflects a return potential of 2.9%. The company has delivered an 8.0% return in the last year. Below, we’ve compared analysts’ price targets and return potential of UPS’s peers in the logistics sector.

- FedEx (FDX): $286.24 with a 15.0% return potential

- Old Dominion Freight Line (ODFL): $154.31 with a 3.4% return potential

- XPO Logistics (XPO): $120.59 with a 12.3% return potential

- YRC Worldwide (YRCW): $13.50 with a 38.4% return potential

- Saia (SAIA): $79.33 with a 1.0% return potential

Transportation and logistics companies are included in the industrial sector. The iShares Global Industrials ETF (EXI) holds 1.91% of its portfolio in UPS.

UPS’s free cash flow target

During United Parcel Service’s (UPS) second-quarter earnings call, senior VP and CFO Richard Peretz said, “This quarter free cash flow gains were driven primarily by an improvement of about $900 million in net working capital. We’re adopting a more global approach to our working capital and accounts payable. This represents one of the many procurement deliverables within UPS’s transformation initiative.”

Peretz continued, “We’re improving the efficiency of our working capital that ultimately contributes to our industry-leading return on invested capital. As a result, we are raising our free cash flow target to $5 billion, the top of our original range.”

For 2018, UPS expects to report capex of $6.5 billion–$7.0 billion. Comparing its capex levels with its operating cash flow, investors could expect UPS to raise its dividend in the current year.