What’s Baker Hughes’s Current Valuation versus Peers?

Baker Hughes, a GE Company (BHGE), is the largest company by market capitalization in our select set of major oilfield services and equipment companies.

Nov. 20 2020, Updated 5:13 p.m. ET

Comparable company analysis

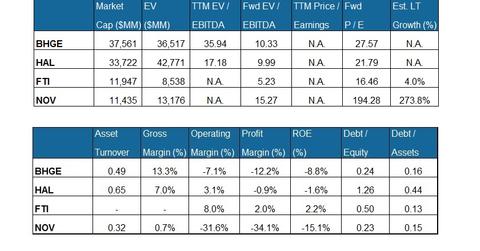

Baker Hughes, a GE Company (BHGE), is the largest company by market capitalization in the select set of major OFS (oilfield services and equipment) companies that we’ll be comparing in this series. National Oilwell Varco (NOV) is the smallest of the lot by market capitalization.

EV-to-EBITDA

Baker Hughes’s EV (enterprise value), when scaled by TTM (trailing-12 month) adjusted EBITDA, is higher than the peer average. Halliburton’s (HAL) TTM EV-to-EBITDA multiple is the lowest in the group.

BHGE’s forward EV-to-EBITDA multiple compression versus its TTM EV-to-EBITDA is sharper than the peer average because the sell-side analysts expect BHGE’s adjusted EBITDA to rise more sharply over the next four quarters than those of its peers. This typically reflects in higher current valuation, expressed as EV-to-EBITDA, than those of peers.

Debt levels

BHGE’s debt to equity (or leverage) multiple is one of the lowest in the group, and this could indicate lower financial risks and a reduced debt load. This also tends to lift investor confidence, particularly when crude oil prices are volatile. NOV’s leverage is the lowest in our group.

Notably, BHGE makes up 2.4% of the SPDR S&P Oil & Gas Equipment & Services ETF (XES). Since June 30, 2017, XES has seen a 16% fall, compared with a ~14% fall in BHGE’s stock price.

PE ratios

Baker Hughes’s forward PE multiple is now positive. This indicates that the sell-side analysts expect BHGE to generate adjusted earnings over the next four quarters. You can read more about OFS companies’ valuation multiples in Market Realist’s series Which Oilfield Service Stocks Look Attractive after 2Q17?

Next, we’ll discuss short interest in BHGE stock.