What Lies Ahead for AvalonBay

Robust 2Q17 results AvalonBay Communities’ (AVB) top and bottom lines exceeded expectations, backed by higher net operating income growth of 8.1%. Factors affecting profit during 2Q17 Higher occupancy and rent growth in development communities and stabilized operating communities led to upbeat results during the quarter. Higher funds from operations expected for 3Q17 AvalonBay expects […]

Aug. 9 2017, Updated 7:41 a.m. ET

Robust 2Q17 results

AvalonBay Communities’ (AVB) top and bottom lines exceeded expectations, backed by higher net operating income growth of 8.1%.

Factors affecting profit during 2Q17

Higher occupancy and rent growth in development communities and stabilized operating communities led to upbeat results during the quarter.

Higher funds from operations expected for 3Q17

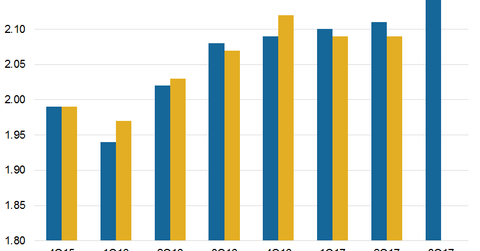

AvalonBay expects to report earnings per share of $2.01–$2.07 during the third quarter, and core FFO (funds from operations) of $2.14 to $2.20.

What lies ahead for AvalonBay in fiscal 2017

AvalonBay is confident that its momentum will continue for the rest of the year. The company has updated its fiscal 2017 outlook, reflecting its 1H17 results and strategic initiatives to boost operating efficiency. AvalonBay now expects to report EPS of $6.24–$6.44, compared with its previous estimate of $6.42–$6.82.

It expects core FFO of $8.50–$8.70 per share, up 5% from the year prior. The company previously expected FFO of $8.44–$8.84 per share. The new guidance, 50 basis points lower than the earlier expectation, forecasts growth of 5.5%. The lower expectation reflects lower NOI (net operating income) and higher operating expenses, which are expected to pressurize margins in the upcoming months.

AvalonBay and peers UDR (UDR), Essex Property Trust (ESS), and Equity Residential (EQR) have seen higher rent over the past few years. However, due to ramped-up supply, the residential REIT sector has reported moderation in rent growth recently, which is expected to continue for the next few months. However, redevelopment of properties and repositioning of assets in Class A cities with high demand have helped companies retain their market share.

The SPDR Dow Jones REIT ETF (RWR), of which the aforementioned stocks form 13%, has traded at an average volume of 164,715 shares. Its volume is expected to rise due to the stocks’ solid 2Q17 results.