UK Inflation Fell: Possible Rough Path Ahead

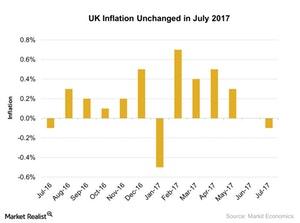

According to a report by the Office for National Statistics, on a monthly basis, the United Kingdom’s inflation fell 0.1 in July 2017.

Aug. 25 2017, Updated 11:35 a.m. ET

UK inflation in July

According to a report by the Office for National Statistics, on a monthly basis, the United Kingdom’s inflation fell 0.1 in July 2017. The inflation index remained unchanged in June 2017. It didn’t meet the market’s expectation of a 0.10% rise.

On a yearly basis, inflation in the United Kingdom was at 2.6% in July 2017—the same as in June 2017. It didn’t meet the market’s expectation of a 2.7% rise. Various factors in the inflation index including prices of clothing, food, and household goods rose in July. Transport, culture, and restaurant prices slowed down in July.

The United Kingdom’s (EWU) annual core inflation stood at 2.4% in July 2017—the same as June 2017. Annual core inflation is an important indicator for the Bank of England’s policy decisions. It excludes the performances of energy, tobacco, and food. In July, the annual core inflation didn’t meet the market’s expectation of a 2.5% rise.

Bank of England’s decision

In the June 2017 review meeting, we saw that three of the Bank of England’s policymakers voted for a rate hike because the inflation was in line with their expectation. Despite slow growth, their tone became hawkish. If we look at the performance in the last two months, inflation didn’t meet the expectation.

The falling inflation in July indicates that demand also remained weaker. If the inflation continues to remain weaker in the future, we might see more risk for the economy. Many international institutions warned that after the Brexit, the United Kingdom might post lower economic growth in the next three years. The United Kingdom’s exit from the European Union (VGK) (EZU) (IEV) could lead to more risks in the economy.

In the next part of this series, we’ll discuss the Eurozone’s inflation in July 2017.