Microsoft’s Value Proposition in the US Software Space

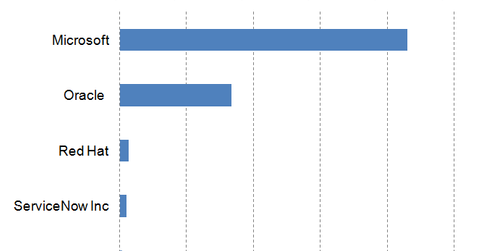

As of April 6, 2016, Microsoft was the largest software player by market capitalization on a global scale. It was followed by Oracle (ORCL).

April 14 2016, Updated 11:06 a.m. ET

Microsoft’s scale in the systems software space

Earlier in this series, we discussed some recent updates of Microsoft (MSFT). Now, let’s look at the value proposition of the company among select software companies in the United States. Let’s start with Microsoft’s size.

As of April 6, 2016, and as the below chart shows, Microsoft was the largest software player by market capitalization on a global scale. It was followed by Oracle (ORCL). Red Hat (RHT), ServiceNow (NOW), and Tableau Software are among the leading players in the systems software space.

Enterprise value multiples of Microsoft

Now let’s look at Microsoft’s EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple and those of select software players in the United States.

Microsoft was trading at a forward EV-to-EBITDA multiple of ~10.10x on April 6, 2016. This metric was lower than Red Hat’s EV-to-EBITDA multiple of ~16.63x. The same metric for Oracle (ORCL) was ~9.05x as of April 6.

Microsoft’s dividend yield

Now, let’s look at Microsoft’s dividend yield along with those of select US software companies. The company’s forward annual dividend yield was ~2.64% as of April 6. This was higher than Oracle’s forward dividend yield of~1.48% as of April 6. Red Hat and ServiceNow do not pay dividends.

For diversified exposure to companies in the US telecom space, you may consider investing in the Technology Select Sector SPDR ETF (XLK). XLK has ~38% exposure toward the application software space.