Headwind for Becton Dickinson: US Dispensing Business

Becton Dickinson (BDX) is the leading player in the US dispensing business. Its Pyxis system sales contribute significantly to the company’s total revenues.

Aug. 28 2017, Updated 10:07 a.m. ET

US dispensing business

Becton Dickinson (or BD) (BDX) is the leading player in the dispensing business in the United States. Its Pyxis system sales contribute significantly to the company’s total revenues. Since the acquisition of CareFusion in 2015, BD has been focused on transforming its medication management business and strengthening the company’s leadership in the market. As part of these efforts, the company has undertaken a number of initiatives, including business model changes in its US dispensing business.

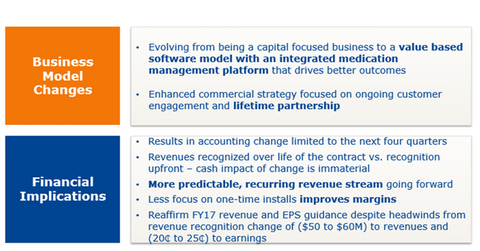

Business model changes

BD initiated a strategic transformation of its US dispensing business model, which was communicated in the last quarter. With its aim to be a more customer-focused robust business, the company initiated a shift from capital placements to a value-based software solutions business model. It has also been working on improving the installation process of its Pyxis system. The company has moved from one-time installations of hardware solutions to providing value through a lifetime solutions, software, and services model. According to BD, “This results in reducing medication errors and drug waste while improving drug availability and hospital cash flow. This also enables customers to benchmark their Medication Management performance versus other hospitals across the country.”

McKesson (MCK), Allscripts Healthcare Solutions (MDRX), and Cerner (CERN) are some of BD’s major competitors in the dispensing business market in the United States. Investors who want to participate in BD can invest in the Vanguard Growth ETF (VUG), which has ~0.44% of its total holdings in BD. Investing in VUG could help diversify the company-specific investment risks for investors.

Financial perspective

BD’s US dispensing business model changes required a change in its accounting method from a capital lease to an accounting lease model. The two methods differ in the way revenue is recognized by the company. Under the capital lease model, revenue used to be recognized for the entire contract value up front. In the accounting lease model, revenue is recognized when it is realized.

These changes led to a one-time, non-cash charge of approximately $495.0 million in 3Q17. Notably, the registered impact was significantly higher than the expected charge of $400.0 million. BD expects to register $50.0 million to $60 million of related headwinds to revenues in fiscal 2017. The related impact to BD’s fiscal 2017 EPS (earnings per share) is expected to be in the range of 2.0% to 3.0%. However, the company expects these business model changes to drive higher growth over the long term, beyond the second half of 2018.

The implementation of the US dispensing business model changes is complete and has received a positive response from customers. According to BD, these changes have not led to any disruption in the company’s market share. Instead, it has had a positive momentum in share gains in this market space.

Next, we’ll take a look at the progress of the Bard acquisition.