GGP’s Generous Return to Stockholders in 2Q17

In 2Q17, GGP (GGP) paid $17.5 million in dividends to its shareholders. That was higher than $13.3 million paid a year ago.

Aug. 10 2017, Updated 7:35 a.m. ET

Dividend payouts

GGP (GGP) has regularly rewarded its stockholders through quarterly dividends. In 2Q17, it paid $17.5 million in dividends to its shareholders. That was higher than $13.3 million paid a year ago.

In August 2017, GGP announced a quarterly dividend of $0.22 per share. That’s 10.0% higher than the quarterly dividend paid in the third quarter of the previous year.

GGP raised its dividend by 11.1% in 4Q16 to $0.22. The annualized dividend paid presently by the company stands at $0.88 per share. GGP also raised its dividend by 10.0% in 3Q16.

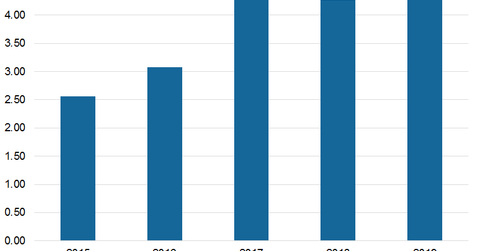

The company has maintained a decent dividend yield of 3.74x over the last 12 months. Its dividend yield was 2.6% and 3.1% in 2015 and 2016, respectively. It’s expected to maintain a dividend yield of 4.3% for the next 12 months, 4.4% for fiscal 2017, and 4.3% for fiscal 2018.

The FFO (funds from operations) payout ratio gives us an idea of how much a company distributes as a dividend from its earnings. That ratio for GGP was 62.8% in 2Q17. It’s expected to be 59.4% in 3Q17.

GGP offers an NTM (next 12-month) dividend yield of 4.0%. Close peers such as Simon Property Group (SPG), Kimco Realty (KIM), and Macerich (MAC) offer dividend yields of 4.4%, 5.4%, and 5.0%, respectively.

The iShares Cohen & Steers REIT (ICF) holds 13.0% in the above REITs. ICF covers all the major mid-cap and high-cap ETFs and offers a yield of 3.8%.