Financing Helped Vornado Maintain Strong Balance Sheet in 2Q17

During 2Q17, Vornado Realty Trust (VNO) reported higher year-over-year top-line and bottom-line results backed by growth in rent and occupancy level.

Aug. 7 2017, Updated 7:36 a.m. ET

2Q17 performance

During 2Q17, Vornado Realty Trust (VNO) reported higher year-over-year top-line and bottom-line results backed by growth in rent and occupancy.

The company has repositioned its properties in the Class A city of New York, which has seen high demand for office space and retail properties. The company has also engaged in significant expansion and development activity in order to maintain its leadership in the industry.

REITs like AvalonBay Communities (AVB), Boston Properties (BXP), and Equity Residential (EQR) depend on debt to fund their working capital, so it’s important for them to leverage their balance sheets properly.

The iShares Cohen & Steers REIT ETF (ICF) invests 12.4% of its portfolio in Vornado and its REIT peers. ICF is worth a look from investors, as its wide product diversity buffers against interest rate hikes.

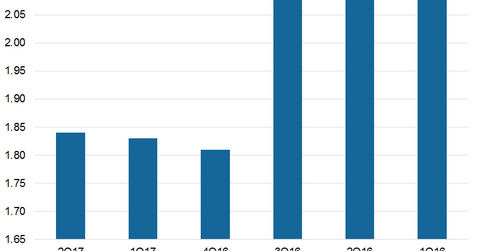

The company maintained a debt-to-equity ratio of 1.84x for 2Q17, which was higher than the industrial mean of 1.07x. During 1Q17, VNO maintained a debt-to-equity ratio of 1.83x.

Financing activities to improve leverage

Vornado has access to debt at attractive rates. During 2Q17, Vornado completed the $220 million financing of theMART. The loan matures in June 2022 and it is an interest only loan at LIBOR plus 170 basis points.

Alexander completed the $500 million refinancing of the office portion of 731 Lexington Avenue. The refinancing decreased interest from LIBOR plus 95 basis points to 90 basis points.

Vornado has a weighted average interest rate of 2.9% and a weighted average maturity term of 3.8 years. Its debt-to-enterprise value stood at 25.2%, and its debt net of cash to EBITDA is 6.9x.

Vornado exited 2Q17 with $3.8 billion in liquidity and of $1.3 billion of cash along with $2.5 billion in revolving credit facilities.