Have Intel and Procter & Gamble Been Able to Increase Dividends?

Intel (INTC) released its 2Q17 results on July 27, 2017. The company’s revenue and EPS for the first half of 2017 rose 8.5% and 72.0%, respectively.

Aug. 9 2017, Updated 7:40 a.m. ET

Intel

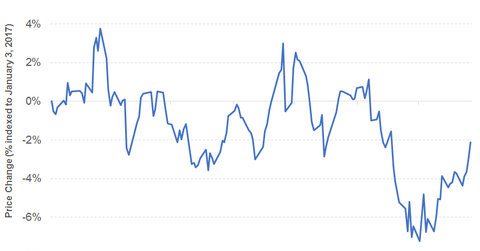

In this part of the series, we’ll take a look at Intel (INTC) and Procter & Gamble (PG). Intel released its 2Q17 results on July 27, 2017. The company’s revenue and EPS (earnings per share) for the first half of 2017 rose 8.5% and 72.0%, respectively. Revenue for 2Q17 rose 9.0%, driven by all the segments except the Programmable Solutions Group. EPS for 2Q17 rose 115.0%, driven by revenue and operating income.

Intel’s 1Q17 revenue rose 8.0%, driven by all its segments except the Programmable Solutions Group. EPS for 1Q17 rose 45.0% on growth in revenue and operating income. The financial results coupled with product launches led to higher revenue and EPS guidance for 2017.

Revenue for fiscal 2016 rose 7.0%, driven by all the segments, partially offset by a small fall in the Non-Volatile Memory Solution Group. EPS for the period fell 9.0%, driven by its operating income. The rise in R&D (research and development) and MG&A (marketing, general, and administrative) expenses weighed heavily on the company’s margin. Intel paid off 0.49% of its earnings as dividends in 2016 compared to 0.41% in 2015. It paid off 0.43% and 0.47% of its earnings as dividends in 1Q17 and 2Q17, respectively.

Intel has recorded consistent growth in its dividend payments since May 1994. The dividend rate remained constant between July 2012 and September 2014. Not only has the company managed to maintain a good free cash flow position but has also managed to improve it every year. It has maintained a holistic debt-to-equity ratio and a fair cash and short-term investment position.

Procter & Gamble

Procter & Gamble’s (PG) fiscal 2017 results were announced on July 26, 2017. Its fiscal 2017 revenue remained flat. The healthcare and corporate segments recorded some growth. EPS for the same period rose 51.0%, driven by earnings from discontinued operations, operating income, lower interest expense, and a lower number of shares outstanding.

Revenue for fiscal 2016 fell 8.0%, driven by all the segments. EPS rose 51.0%, driven by operating income, lower interest expense, earnings from discontinued operations, and lower shares outstanding. The company paid off 0.76% of its earnings as dividends in 2016 compared to 0.91% in 2015. It paid off 0.73% of its earnings as dividends in 2017.

Procter & Gamble has recorded consistent growth in its dividend payments since October 1990. Not only has it managed to maintain a strong free cash flow position, it has also managed to improve it every year. Its debt-to-equity ratio has remained at a lower level. The company has managed to grow its cash and short-term investment position over the years.

The Vanguard Dividend Appreciation ETF (VIG) offers a dividend yield of 2.1% at a PE (price-to-earnings) ratio of 23.0x. It has the highest exposure to industrials. The First Trust Value Line Dividend ETF (FVD) offers a dividend yield of 2.1% at a PE ratio of 21.4x. The fund has the most exposure to utilities.