Why Distributed Ledger Technology Is Game Changing

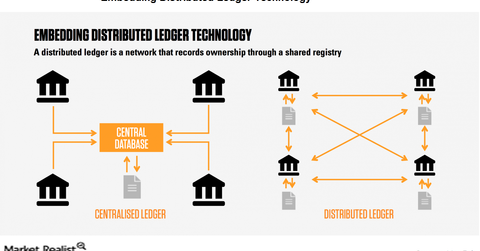

A distributed ledger is a database of transactions held and updated in decentralized form across different locations.

Nov. 20 2020, Updated 11:22 a.m. ET

VanEck

Distributed Ledger Technology is Game Changing

The most significant development that has come out of the digital currency craze is validation of distributed ledger technology. This technology has the potential to revolutionize many aspects of the financial system, trade, and essentially anything where records are maintained. A secure system that eliminates middle men has obvious advantages. Imagine trading stocks without brokers, transfer agents, and custodians ― a scenario where fees are likely to disappear.

Equally as significant, digital currencies have caused many to question what exactly a currency should be and whether there is a better alternative to fiat currency. The monetary system is broken. Central banks seem powerless to prevent the economy from going through busts that destroy wealth and create hardship. Currency volatility under the fiat system has been extreme. Politics, corruption, and mismanagement are a constant concern.

Technology Likely to Improve Gold Ownership Efficiency

Combining distributed ledger technology with an established sound and solid currency may provide the best alternative. To this end, later in 2017 the Royal Mint in the U.K. is set to launch Royal Mint Gold (RMG). RMG will be a digital record of ownership for gold stored at its vault, while CME Group will operate the product’s distributed ledger platform. It will carry the option to convert to physical gold. It is not clear whether this product will enable consumer purchases with some type of RMG credit card. Regardless, technology is accelerating towards the day when gold can be used both as a store of wealth and an efficient medium of exchange.

Digital Currencies Are Not Likely to Replicate Gold’s Unique Role

Bitcoin and other digital currencies are a fad that has attracted the attention of programmers, speculators, and early adaptors. Given the fundamental characteristics of gold and digital currencies, we do not believe digital currencies will ever replicate or replace gold’s unique role as a form of portfolio insurance and as a hedge against tail risk. It is my opinion that governments will not allow digital currencies to reach the critical mass needed to challenge the utility of fiat currencies. At best, digital currencies may eventually occupy some middle ground as a niche product. At worst, they become a failed experiment that ends in tears. For now, the only thing we can forecast with confidence in the digital currency space is more volatility.

Market Realist

A distributed ledger is a database of transactions held and updated in decentralized form across different locations. As the above chart shows, it removes the need for a central authority. The data are stored using cryptography and accessed using cryptographic signatures, which keeps the data secure.

Ledgers that are centralized could be vulnerable to cyberattacks. However, distributed ledgers are harder to attack because all of the distributed copies have to be attacked at the same time for the attack to take place.

As we mentioned in the previous part, bitcoin has a long way to go before it can compete with gold (GLD)(OUNZ) as a safe-haven asset. Gold is much less volatile and provides a valuable hedge when stocks (SPY) are down.