Could Domino’s Earnings Rise in the Next 4 Quarters?

Earnings expectations For the next four quarters, analysts expect Domino’s Pizza (DPZ) to post EPS (earnings per share) of $6.14, which represents a growth of 22.3% from the EPS of $5.02 seen in the four quarters prior. EPS growth Domino’s EPS growth is expected to be driven by higher revenue, EBIT (earnings before interest and tax) […]

Dec. 4 2020, Updated 10:52 a.m. ET

Earnings expectations

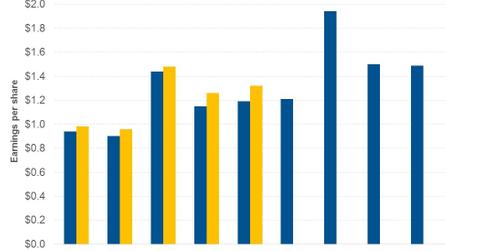

For the next four quarters, analysts expect Domino’s Pizza (DPZ) to post EPS (earnings per share) of $6.14, which represents a growth of 22.3% from the EPS of $5.02 seen in the four quarters prior.

EPS growth

Domino’s EPS growth is expected to be driven by higher revenue, EBIT (earnings before interest and tax) margin expansion, and share repurchases.

During the next four quarters, analysts expect the company’s EBIT margins to expand from 18.2% to 18.7%. The expansion in EBIT margins is expected to be driven by lower costs of sales and a decline in D&A (depreciation and amortization) expenses. Analysts expect Domino’s costs of sales to fall from 69.1% to 68.5%, while D&A expenses are projected to fall from 1.6% to 1.5%. However, some of the expansion in EBIT margins is expected to be offset by a rise in SG&A (selling, general, and administrative) expenses from 12.7% to 12.8%. Higher labor wages and investments in technological advancements are expected to increase the company’s SG&A expenses.

Domino’s has repurchased shares worth $60 million in the last four quarters. By the end of 2Q17, the company had $136.4 million under its share repurchase program. Share repurchases boost a company’s EPS by lowering the number of shares outstanding.