Commercial REITs Have Higher Debt-to-Equity Ratios

GGP’s (GGP) debt-to-equity was 1.55x for 2Q17, which was higher than the industrial mean of 1.07x. As of 2Q17, GGP had $2.0 billion of liquidity.

Aug. 11 2017, Published 3:51 p.m. ET

Balance sheet levering matters

REITs fund their working capital with the help of debt and equity. However, too much dependence on external funds can result in liquidity and increase the cost of debt. So all REITs are cautious about levering their balance sheets properly.

Let’s see how the three commercial REITs carried out their refinancing activities in order to keep their balance sheets strong.

High debt-to-equity ratios compared to the industry

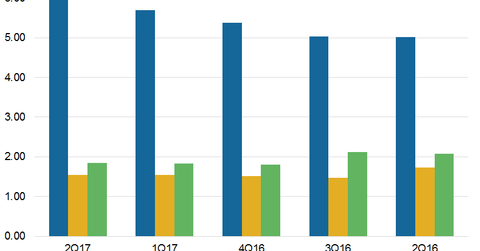

Simon Property Group’s (SPG) debt-to-equity ratio was 6.36x in 2Q17, which was higher than the industrial mean of 1.08x. As of 2Q17, its liquidity stood at $6.5 billion, comprised of cash on hand, a portion of joint venture cash, and existing credit under its revolving facilities.

GGP’s (GGP) debt-to-equity was 1.55x for 2Q17, which was also higher than the industrial mean of 1.07x. As of 2Q17, GGP had $2.0 billion of liquidity. The company had no maturities due in 2017. Most of them are weighted toward the second half of 2017.

Vornado Realty Trust (VNO) reported a debt-to-equity ratio of 1.84x for 2Q17, which was higher than the industrial mean of 1.07x. VNO exited the quarter with $3.8 billion in liquidity made up of $1.3 billion in cash and $2.5 billion in revolving credit facilities.

Financing activities to improve the balance sheet leverage

In 2Q17, Simon Property Group completed a senior notes offering of $1.4 billion with a weighted average coupon rate of 3.0% and an average term of 7.8 years. It also retired two series of senior notes worth ~$1.9 billion, which helped the company lower the weighted average coupon rate almost 150 basis points. It also paid off six mortgage loans worth $1.1 billion.

GGP paid off its secured debt financing at the Mall of Lousiana. It also refinanced the Seritage property and took new loans with lower interest rates and longer maturity.

Vornado also paid off the $220.0 million financing of theMART in June 2017. Its subsidiary, Alexander, completed the refinancing of the $500.0 million loan of the office portion of 731 Lexington Avenue, which lowered the interest from 95 basis points to 90 basis points.

SPG, GGP, VNO, and Prologis (PLD) make up 14.0% of the Vanguard REIT ETF (VNQ). VNQ has a net asset value of $84.24 per share.

In the next part, we’ll see how these REITs rewarded their stockholders in 2Q17.