Can Cisco’s Switching and Routing Revenue Continue to Fall?

Cisco Systems’ (CSCO) Switching business revenue has fallen 4.0% YoY (year-over-year) to $10.5 billion in the first nine months of fiscal 2017.

Dec. 4 2020, Updated 10:53 a.m. ET

Switching revenue has fallen 4% YoY in first 9 months

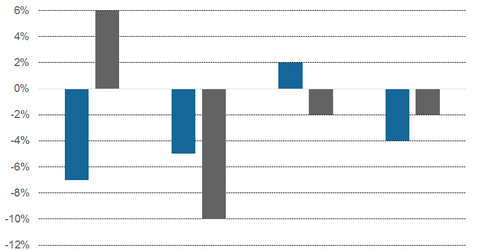

Cisco Systems’ (CSCO) Switching business revenue has fallen 4.0% YoY (year-over-year) to $10.5 billion in the first nine months of fiscal 2017. The revenue fell 7.0% YoY in fiscal 1Q17 to $3.7 billion, and it fell 5.0% YoY to $3.3 billion in fiscal 2Q17. It rose 2.0% YoY to $3.5 billion in fiscal 3Q17. Switching is Cisco’s largest business segment and accounts for approximately 30.0% of its total revenue.

Cisco’s Routing business revenue has fallen 2.0% YoY (year-over-year) to $5.9 billion in the first nine months of fiscal 2017. Revenue rose 6.0% YoY in fiscal 1Q17 to $2.1 billion and fell 10.0% YoY to $1.8 billion in fiscal 2Q17 and 2.0% YoY to $2.0 billion in fiscal 3Q17. Routing is Cisco’s second-largest business segment and accounts for approximately 17.0% of its total revenue.

Cisco leads the global switching and routing segment

According to market research firm IDC (International Data Corporation), Cisco continues to lead the switching market with a share of 55.1% at the end of 1Q17, compared to 55.6% in 4Q16 and 59.0% in 1Q16. The other players include Huawei, Hewlett Packard Enterprise (HPE), Juniper Networks (JNPR), and Arista, with shares of 6.3%, 6.0%, 4.3%, and 5.1%, respectively.

In the worldwide routing space, Cisco has a market share of 43.9% at the end of 1Q17, compared to 48.8% in 1Q16 and 42.2% in 4Q16. Juniper Networks and Huawei have market shares of 15.6% and 19.8%, respectively, at the end of 1Q17.

Cisco is facing competition from China’s (FXI) Huawei, which has significantly grown its share in the routing and switching markets over the last few years. Huawei is targeting growth in emerging markets and has become one of the leading telecommunications hardware firms.