Bitcoin Might Not Replace Gold as a Safe-Haven Asset

Bitcoin is a global digital payment system that offers lower transaction fees than other online payment systems. It’s operated by a decentralized authority.

Aug. 18 2017, Updated 1:06 p.m. ET

VanEck

Gold is Physical, Bitcoin is Digital

Recently, we have received many questions about digital currencies and in particular, bitcoin (defined as the world’s first decentralized digital currency). The queries range from our general opinion to concerns that bitcoin might displace gold demand. While we have no digital currency experts on our gold team, we follow the development of these new currencies with interest. It is clear that those who promote bitcoin are using gold’s image to help validate their product. Press articles are often accompanied by a picture of stacks of shiny gold colored bitcoins. Bitcoins are created by “miners”. This is aimed at creating the illusion of a solid currency. In reality, digital currencies are strings of 0s and 1s stored in a computer in some unknown location and cannot be touched or seen.

There are, however, several important similarities between gold and bitcoin. Both are outside of the mainstream financial establishment. Both are not issued or controlled by governments, and both are traded around the globe across borders. Supply of both gold and bitcoin is limited, so they are sound forms of currency. For most transactions to be used in an economy, they must be converted into paper currency.

Market Realist

Bitcoin is a global digital payment system that offers lower transaction fees than other online payment systems. It’s operated by a decentralized authority—unlike currencies like the US dollar (UUP) that are controlled by their respective governments.

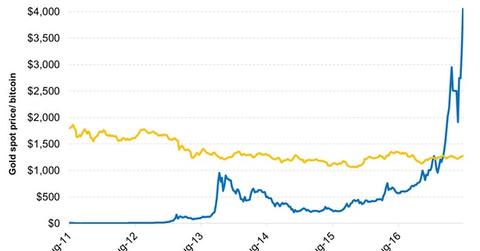

As the above graph shows, the demand for bitcoin has soared, which caused bitcoin rates to gallop. The current market cap for all bitcoin in circulation is in excess of $7 billion. Meanwhile, gold (OUNZ) prices have been more or less flat during the same period.

Bitcoin lovers envision the unlimited use of the crypto-currency. They envision it as the “gold of the digital era”—a safe-haven asset for individuals to park their money in the tumultuous financial world.

However, while some individuals think that bitcoin could replace gold as a safe-haven asset, here’s why that might not happen. Bitcoin is way more volatile compared to gold, the “store of value,” as the above graph suggests. While gold prices aren’t immune to volatility, bitcoin prices are much more volatile than gold prices, which could discourage mainstream investors from using bitcoin as a safe-haven asset.