Asian Markets Are Mixed on August 31

On August 31, 2017, the Shanghai Composite Index fell 0.08% and ended at 3,360.81. The SPDR S&P China ETF (GXC) rose 0.83% and closed at 100.33.

Aug. 31 2017, Published 8:49 a.m. ET

Economic calendar

8:30 AM EST – US core PCE price index (July)

8:30 AM EST – US initial jobless claims

8:30 AM EST – US personal spending

9:45 AM EST – US Chicago PMI (purchasing managers’ index) (August)

10:00 AM EST – US pending home sales (July)

7:50 PM EST – Japan’s capital spending (Q2)

9:45 PM EST – China’s Caixin manufacturing PMI

China

Following a two-week rising streak, China’s Shanghai Composite Index started this week on a stronger note. It was above the important resistance level of 3,300 and rose to fresh 20-month high price levels. The market remained flat on August 30 amid geopolitical concerns and the stronger yuan.

Despite the improved sentiment and supporting economic data, the market is consolidating near the resistance level of 3,300. According to data from the China Logistics Information Centre, China’s manufacturing PMI (purchasing managers’ index) rose to 51.7 in August—better than the market’s forecast of 51.3. The manufacturing PMI reading above 50 indicates an expansion in manufacturing activity. The market is looking forward to the release of China’s Caixin manufacturing PMI data that are scheduled to release at 9:45 PM EST today.

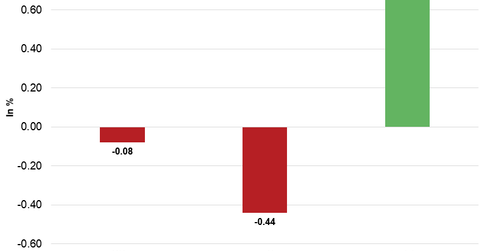

On August 31, 2017, the Shanghai Composite Index fell 0.08% and ended at 3,360.81. The SPDR S&P China ETF (GXC) rose 0.83% and closed at 100.33.

Hong Kong

With an improved market sentiment last week and stronger-than-expected earnings, Hong Kong’s Hang Seng Index started this week on a stronger note. However, the market lost momentum on Tuesday amid North Korea launching a missile over Japan. Due to the improved global sentiment and less concern about North Korea, the market regained strength on August 30. Despite a rally in Wall Street and China’s stronger-than-expected manufacturing data, the Hang Seng Index opened lower and fell on Thursday. The profit-booking in Hong Kong’s markets along with a pullback in Chinese banks in Hong Kong’s markets weighed on the Hang Seng Index on Thursday.

On August 31, the Hang Seng Index fell 0.44% and closed the day at 27,970.30. On August 30, the iShares MSCI Hong Kong Index (EWH) rose 0.41% and closed at 24.5.

Japan

After regaining strength on August 30, Japan’s Nikkei Index started today on a stronger note by opening higher. The weaker yen and the stronger market sentiment improved the risk appetite in Japanese markets on Thursday. Amid decreased concerns about North Korea and the weaker yen, exporters gained on Thursday and supported the Nikkei Index.

The Nikkei Index closed the day at 19,646.24—a gain of 0.72%. The iShares MSCI Japan Index (EWJ) fell 0.06% to 54.28 on August 30.

In the next part of this series, we’ll see how European markets performed in the morning session on August 31, 2017.