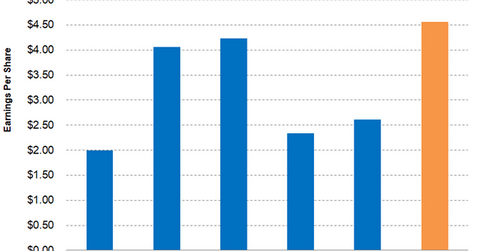

Analysts Expect Sherwin-Williams’ 2Q17 Adjusted EPS to Rise

Analysts expect Sherwin-Williams (SHW) to post adjusted EPS (earnings per share) of $4.56 in 2Q17—an increase of 12.2% on a year-over-year basis.

July 14 2017, Published 8:04 a.m. ET

Sherwin-Williams’ 2Q17 adjusted EPS estimate

Analysts expect Sherwin-Williams (SHW) to post adjusted EPS (earnings per share) of $4.56 in 2Q17—an increase of 12.2% on a year-over-year basis. In 2Q16, Sherwin-Williams reported adjusted EPS of $4.06.

The expected growth in the adjusted EPS is driven by the acquisition of Valspar. The acquisition is expected to generate $320 million of synergies in cost savings over the next three years. Analysts expect Sherwin-Williams’ 2Q17 SG&A (selling, general and administrative) expenses to be at $1.19 billion—32.30% of its expected sales. In 2Q16, Sherwin-Williams’ SG&A expenses were $1.05 billion—32.8% of the revenue. It’s a reduction by 45 basis points in SG&A expenses.

Will Sherwin-Williams resume its share buyback?

Companies adopt share buybacks to boost earnings per share. In 1Q17, Sherwin-Williams didn’t make any share repurchases due to the pending approval of Valspar’s acquisition. Now that the acquisition is complete, it remains to be seen whether Sherwin-Williams resumes its share repurchasing program. Sherwin-Williams has been authorized to acquire 11.65 million common shares. In the past ten years, Sherwin-Williams has reduced more than 36 million outstanding shares. At the end of 1Q17, Sherwin-Williams had 94.54 million outstanding common shares.

Investors looking to get exposure to Sherwin-Williams can invest in the PowerShares DWA Industrials Momentum Portfolio ETF (PRN). PRN has invested 4.60% of its portfolio in Sherwin-Williams. The fund’s top holdings include TransDigm (TDG), Lockheed Martin (LMT), and Gartner (IT) with weights of 4.90%, 4.50%, and 3.70%, respectively, as of July 12, 2017.

In the next part, we’ll discuss analysts’ recommendations for Sherwin-Williams.