Will Vornado Benefit from a Growing Economy in 2Q17?

Although Vornado Realty Trust (VNO) may witness lower margins during a higher interest rate environment, it may see significant growth in the near future.

July 26 2017, Updated 10:39 a.m. ET

Higher revenue growth in 2Q17

Although Vornado Realty Trust (VNO) may witness lower margins during a higher interest rate environment, it may see significant growth in the near future, as higher interest rates are usually coupled with a growing economy.

The central bank hiked interest rates in March and June 2017 and has a target interest rate of 2%. The Fed’s decision to hike rates was supported by growing GDP, lower inflation, and an improved employment rate.

Growing economy and Vornado

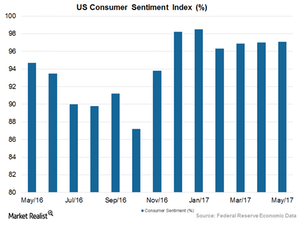

Trump’s pro-American policy has promoted a sense of confidence in the US economy. Lower gas prices, higher disposable income, and lower unemployment have made consumers optimistic about the condition of the economy.

Further, higher job growth in the country has resulted in growing demand for office buildings. In this scenario, the company is disposing of properties in low demand cities and has concentrated on building office buildings in premium locations in Manhattan. Such steps are expected to drive higher margins in the upcoming quarter.

Other peers in the same industry like AvalonBay Communities (AVB), Boston Properties (BXP), and Equity Residential (EQR) are expected to report revenues of $529.11 million, $639.45 million, and $608.57 million, respectively.

Vornado and its residential REIT peers together constitute 12.4% of the iShares Cohen & Steers REIT ETF (ICF).