Where Public Storage Stands among Other Major Players

Public Storage has consistently been able to return capital value as well as shareholder returns in the form of dividends and share buybacks.

July 26 2017, Updated 7:36 a.m. ET

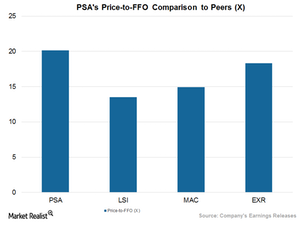

Price-to-FFO multiple

The price-to-FFO multiple is the best ratio to evaluate REITs (real estate investment trusts) like Public Storage (PSA). For REITs, the price-to-FFO (funds from operations) multiple has the same significance as the PE (price-to-earnings) ratio for other industries.

Peer group price-to-FFO multiple

PSA’s current price-to-FFO multiple is ~20.1x. Public Storage has consistently been able to return capital value as well as shareholder returns in the form of dividends and share buybacks.

Several locations of PSA’s storage facilities, in addition to partnerships entered by the company during 1Q17, have triggered a spike in PSA’s share price.

Life Storage (LSI) trades at ~13.5x, while Macerich (MAC) and Extra Space Storage (EXR) trade at ~14.9x and ~18.3x, respectively.

Peer group dividend yield

Dividend yield helps measure the valuation of an REIT. PSA currently offers a next-12-month dividend yield of 3.9%, which is in line with its close competitors. Life Storage offers a dividend yield of 5.4%, while Macerich offers a dividend yield of 4.8%. Extra Space offers a dividend yield of 4%.

Public Storage and Extra Space together make up 9% of the iShares Cohen & Steers REIT ETF (ICF).