What’s the Short Interest in Large OFS Companies on July 6?

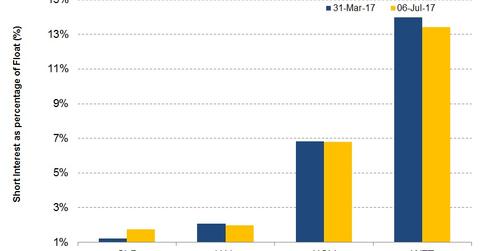

Short interest in Schlumberger (SLB) as a percentage of its float is 1.2% as of July 6, 2017, compared to 1.2% as of March 31, 2017.

Nov. 20 2020, Updated 2:04 p.m. ET

Short interest in Schlumberger

Short interest in Schlumberger (SLB) as a percentage of its float is 1.2% as of July 6, 2017, compared to 1.2% as of March 31, 2017. Since March 31, short interest in SLB has risen 2%.

Since March 31, 2017, SLB’s stock price has fallen ~17%. SLB makes up 6.1% of the ProShares Ultra Oil & Gas (DIG). DIG has fallen 18% since March 31, 2017. The SPX-INDEX has risen 3% since March 31, 2017.

Did crude oil prices affect investor sentiment?

Crude oil prices have turned bearish in 2017. Since March 31, 2017, prices have fallen 10% as of July 6. As a result, investors’ sentiment towards the energy market has also waned. Many oilfield equipment and services (or OFS) companies’ stock prices have tanked in the past three months. Earlier, during fiscal 2016, SLB’s stock price rose 20%, while the West Texas Intermediate (or WTI) crude oil price went up 45% during the year.

Short interest in HAL, NOV, and WFT

Short interest in Halliburton (HAL) as a percentage of its float was 1.9% as of July 6, 2017. Since March 31, 2017, short interest in Halliburton has fallen 5%, while HAL’s stock price fell 15%. Short interest in National Oilwell Varco (NOV) as a percentage of its float was 6.9% as of July 6, 2017. Short interest in National Oilwell Varco has risen 2% since March 31, 2017, while its stock price fell 19%. Short interest in Weatherford International (WFT) has risen 9% since March 31, while its stock price fell 46% during this period. Typically, more investors expect a stock’s price to fall if short interest rises as a percentage of float. Read more on WFT in Market Realist’s Why Weatherford International Fell despite Margin Improvement.

Next, we’ll discuss analysts’ recommendations for SLB, HAL, NOV, and WFT.