What’s Going on in Intel’s Programmable Solutions Group?

Intel is offering a full spectrum of AI solutions and several accelerators. The company’s journey in accelerated computing began with its acquisition of Altera in 2015.

July 21 2017, Updated 9:06 a.m. ET

Intel’s Programmable Solutions Group

Intel (INTC) is offering a full spectrum of AI (artificial intelligence) solutions and several accelerators.

The company’s journey in accelerated computing began with its acquisition of Altera in 2015. This acquisition led to the creation of Intel’s PSG (Programmable Solutions Group) segment, which offers FPGAs (field programmable gate array) to Intel and third parties. PSG competes with Altera’s rival Xilinx (XLNX), a leader in the FPGA market.

PSG’s earnings

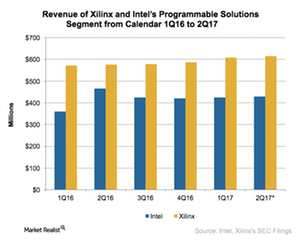

In 1Q17, the PSG segment’s revenue rose 18% YoY (year-over-year) to $425 million. However, after adjusting for acquisition-related accounting charges, the segment’s revenue fell 7% YoY as growth in the industrial, auto, and consumer markets was offset by weakness in the data center and communications markets.

1Q17 is a seasonally weak quarter in the data center and networking space, and 1Q17 was weaker than normal because large cloud and networking providers purchased more than usual in 2H16. Even Xilinx witnessed weakness the data center and communications spaces in 1Q17. However, this weakness was more than offset by strong growth in the industrial, auto, and consumer markets, which accounted for 59% of the company’s revenue. Xilinx’s revenue rose 7% YoY in 1Q17.

Intel expects its PSG segment’s revenue to recover in 2Q17 and beyond and to rise 6% YoY to $1.8 billion in 2017.

Intel’s efforts in the PSG space

Intel has started a pilot FPGA acceleration service with China’s Alibaba (BABA) Cloud. Moreover, the company is looking to add another AI accelerator based on its Nervana technology in 2018.

Intel’s security business

While Intel is expanding its AI portfolio, it’s reducing its exposure to noncore technologies. In April 2017, it spun its security business off into a separate entity by selling a 49% stake in the business for $3.1 billion. This sale generated a pretax revenue rise of ~$375 million.

Next, we’ll look at the company’s memory business.