The Top Dividend-Growing Healthcare and Industrials Stocks

The sector has seen the weakest growth in its top and bottom lines due to uncertainty in terms of sector reforms.

July 12 2017, Published 2:44 p.m. ET

Healthcare

Healthcare Select Index sales, earnings, and dividends have grown at a CAGR[1. Compound annual growth rate] of 7.9%, 8.6%, and 9.8%, respectively, between 2012 and 2017. The sector has seen the weakest growth in its top and bottom lines due to uncertainty in terms of sector reforms.

AbbVie

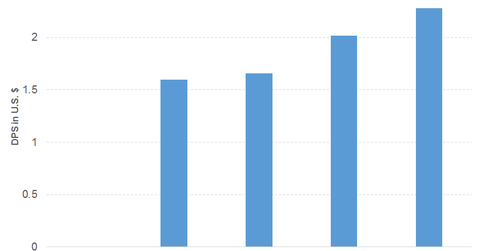

AbbVie (ABBV) has recorded consistent revenue growth since fiscal 2011. It recorded growth in operating income and EPS [2. Earnings per share] in the last two years. The 1Q17 revenue growth was driven by Humira and Imbruvica. This performance led to growth in operating income and EPS.

The company has always generated enough free cash flow to honor its dividend obligations in the last five years. It has also maintained a strong cash balance. However, the company’s debt-to-equity ratio has risen over the years. Its stock price has risen 18.5% on a YTD[3. Year-to-date] basis.

AbbVie’s PE [4. Price-to-earnings ratio] of 19.7x compares to a sector average of 45.4x. The company offers a dividend yield of 3.5%. Abbvie had a dividend payout ratio of 60% in fiscal 2016.

Industrial goods

Industrial Select Index sales, earnings, and dividends have grown at a CAGR of 1.5%, 6.2%, and 10.6%, respectively, between 2012 and 2017. The sector margins and EPS are being driven by lower national energy prices.

Emerson Electric

Emerson Electric’s (EMR) revenue has fallen in the last three years, driven by weak oil and gas prices, feeble industrial and emerging market business outlay, a strong US dollar, and global economic uncertainty. Weak energy-related spending and industrial markets have played a major role. Operating income fell in the last two years, and EPS fell in the last year. Revenue, operating income, and EPS have fallen in 1Q17.

The company has generated enough free cash flow in the last five years to pay off its dividends, unlike 6M17. It maintains a strong cash balance. Ametek (AME) has a slightly higher debt-equity ratio than Emersion Electric, which is within acceptable limits. Its stock price has grown 6.7% on a YTD basis.

Emerson Electric’s PE of 24.2x compares to a sector average of 28.4x. Its dividend yield of 3.2% compares to a sector average of 1.9%. Ametek offers a dividend yield of 0.6% at a PE of 28.1x.

Emerson Electric had a dividend payout ratio of 67.2% in fiscal 2016 compared to Ametek at 15.7%.