Sector Rotation Could Be the New Theme for the S&P 500

According to the latest Commitment of Traders report, large speculators have increased their net bullish positions in the S&P 500 futures.

July 4 2017, Updated 9:09 a.m. ET

Best first half for S&P 500 in four years

The S&P 500 Index (SPY) recorded its best first half in four years, gaining ~8.0%. In the previous week, the index witnessed higher levels of volatility and closed on a weak note at 2,423.41, losing 0.61% of its value.

Continued weakness in the tech sector (XLK) dragged the index lower in June, with the S&P technology sector (RYT) posting its first monthly loss in 2017.

The primary theme in the last few weeks has been the sector rotation from technology (IYW) to the other sectors—primarily the financial sector (XLF) on the back of favorable banking stress tests.

Speculative bullish positions increased marginally

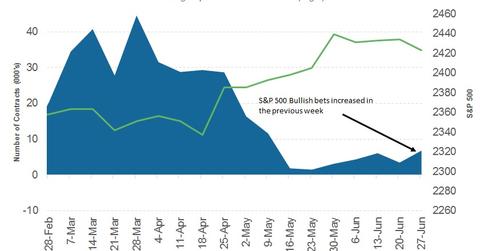

According to the latest Commitment of Traders report, large speculators have increased their net bullish positions in the S&P 500 futures. This is the fourth straight week of an increase in bullish bets. The total net positions stood at 1,813 contracts, a marginal increase of 67 contracts from the previous week.

This data is only tabulated through June 27, 2017, and there may have been changes in the holding pattern. Traders would have exited some positions before the long weekend and in response to the tech sector sell-off on June 29, 2017.

The week ahead for the S&P 500

In this holiday-shortened week, investors could focus on payroll data and how that could impact the Federal Reserve’s outlook for the US economy. The upcoming US economic calendar includes the minutes of the last FOMC[1. Federal Open Market Committee] meeting, the ISM manufacturing and services reports, and auto sales data.

Apart from these reports, several Fed officials are scheduled to speak this week. Their views could be scrutinized to assess the next move from the Fed.