Public Storage and the Growing US Economy

Public Storage (PSA) is expected to witness a higher cost of debt in 2Q17, mainly due to the Fed’s rate hikes in 2017.

July 25 2017, Updated 10:37 a.m. ET

Higher revenue growth in 2Q17

Public Storage (PSA) is expected to witness a higher cost of debt in 2Q17, mainly due to the Fed’s rate hikes in 2017. Although PSA’s margins may be slightly lower due to interest expenses, they could take off soon, backed by the robust fundamentals of the company.

Growing economy

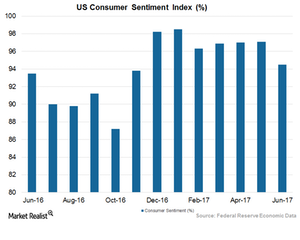

Consumer sentiment in the US witnessed a sharp rise in the first half of 2017. A lower level of reported unemployment, the steadily growing GDP, and an economy eager to boom have made many consumers confident about the well-being of the country. Meanwhile, the upcoming tax reforms touted by President Trump—if passed by Congress—could increase the disposable incomes of many consumers.

At the same time, high rent growth has compelled many consumers to move into smaller apartments, which has increased the demand for storage facilities. This trend is expected to continue in 2Q17.

Life Storage (LSI), Macerich (MAC), and Extra Space Storage (EXR) are also reporting expansions and acquisitions to maintain profitability. Public Storage and Extra Space together make up 9% of the iShares Cohen & Steers REIT ETF (ICF).