Prologis: What Analysts Recommend for the Stock

Analysts have assigned Prologis stock a mean price target of $58.47, which is 2.1% higher than its current price of $57.28.

July 13 2017, Updated 9:06 a.m. ET

Analyst ratings

Prologis’s (PLD) expected performance in the second quarter of 2017 is reflected in its analyst ratings. Analysts have assigned Prologis stock a mean price target of $58.47, which is 2.1% higher than its current price of $57.28.

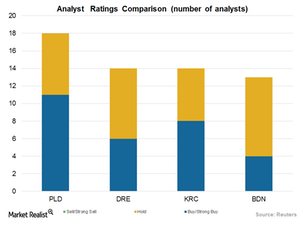

Currently, 11 of the 18 analysts have assigned a “buy” or “strong buy” rating for PLD stock. The remaining seven analysts have given it a “hold” rating. PLD’s higher-than-expected results in 1Q17 coupled with the company’s strategic initiatives, leading to higher occupancy levels, have made analysts bullish on the stock.

Compared to the ratings in March 2017, the number of PLD’s “strong buy” and “buy” ratings have remained the same at 11, compared to ten in June 2017.

Ratings for Prologis’s peers

Six of the 14 analysts covering Duke Realty (DRE) have given the company a “buy” or “strong buy” rating. Eight have given it a “hold” rating.

Eight of the 14 analysts who cover Kilroy Realty (KRC) have given the company a “buy” or “strong buy” rating. Six analysts have given it a “hold” rating.

Four of the 13 analysts covering Brandywine Realty Trust (BDN) have given it a “buy” or “strong buy” rating. Nine have given it a “hold” rating.

Prologis makes up 6.7% of the iShares Cohen & Steers REIT (ICF). ICF’s broadly diversified portfolio provides a cushion against industrial and macroeconomic headwinds and volatility.