Norfolk Southern: International Pushed Intermodal Revenues in 2Q17

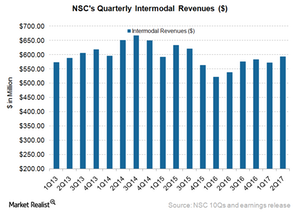

NSC’s Intermodal segment’s revenues rose 10% to $593.0 million from $538.0 million in 2Q16.

Aug. 1 2017, Updated 9:10 a.m. ET

Intermodal segment’s revenues in 2Q17

In 2Q17, Norfolk Southern (NSC) recorded a double-digit rise in its Intermodal segment’s revenues. NSC’s Intermodal segment’s revenues rose 10% to $593.0 million from $538.0 million in 2Q16. The Intermodal segment’s share in total revenues rose slightly to 22.5% in 2Q17 from 21.9% in 2Q16.

Intermodal volumes in 2Q17

In 2Q17, Norfolk Southern registered a 6% rise in volumes to more than 1.0 million units, and its domestic intermodal shipments rose. This rise was due to the sustained pace of highway-to-rail conversions. However, the excess truck capacity (JBHT) (SWFT) negatively impacted the domestic intermodal volume gains.

NSC witnessed a 5% gain in international intermodal shipments in 2Q17. The company’s liaison with its shipping partners at the East Coast ports pushed its international intermodal volumes. NSC’s intermodal revenue per unit rose 4% in 2Q17. However, the abundant truck traffic on the road had checked intermodal pricing.

Management insight in 2017

Norfolk Southern (NSC) believes that the domestic intermodal market could be impacted by excess truck capacity. However, the company anticipates improvements after 2017. According to Norfolk Southern, the anticipated tightening truck capacity in 2018 could trigger solid pricing growth.

In the lower fuel price environment, the pace of highway-to-rail conversions will not be rapid. In our view, NSC may not gain from this situation. The implementation of ELDs (electronic logging devices) in the trucking industry (LSTR) could result in service disruptions, which would benefit the intermodal rail sector.

Higher volumes and network alignments at East Coast ports could drive Norfolk Southern’s international intermodal volumes.

ETF investment

Investors interested in the transportation space can consider the iShares US Industrials ETF (IYJ), which holds ~5.9% of its portfolio in US Class I railroads.

Norfolk Southern reported improvements in its 2Q17 operating margins, which we’ll examine in the next article.