Inside Public Storage’s 2Q17 Battle with Macro Headwinds

Public Storage (PSA) is expected to post flat top-line and bottom-line results in 2Q17.

July 25 2017, Updated 9:07 a.m. ET

Earnings and revenue expected to grow in 2Q17

Public Storage (PSA) is expected to post flat top-line and bottom-line results in 2Q17. Its adjusted FFO (funds from operation) are expected to come in at $2.84, while its revenue is expected to be $667.9 million.

The company is expected to witness higher expenses for 2Q17, and these could offset rent growth.

Meanwhile, the Fed is geared up to hike the interest rate a third time in 2017 later this year. The increase in the interest rate is part of the Fed’s target to achieve a rate of 2%.

Margins may be under pressure in 2Q17

PSA’s cost of debt is expected to go up in 2Q17 mainly due to higher interest rates. REITs (real estate investment trusts) source their funds mainly through debt and equity funds.

Sources of funds may thus become scarce as PSA’s lenders will have to bear the brunt of the higher costs of bank loans and mortgages.

Wall Street expects PSA to report EBITDA (earnings before interest, tax, depreciation, and amortization) of $387.6 billion—63.7% higher than in 2Q16. PSA’s interest expenses are expected to be ~7% higher YoY at $92.2 million.

Strong fundamentals to offset macro issues

However, the negative impact of the higher cost of debt is expected to be offset by PSA’s strategic initiatives. The company has repositioned its storage facilities in the busiest towns and business centers, in close proximity to multifamily apartment units, academic institutions, and retail outlets.

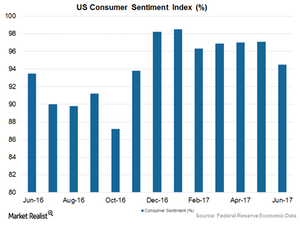

The growing US economy is also expected to have boosted PSA results for the second quarter.

PSA’s peers include Life Storage (LSI), Macerich (MAC), and Extra Space Storage (EXR). Public Storage and Extra Space together make up 9% of the iShares Cohen & Steers REIT ETF (ICF).