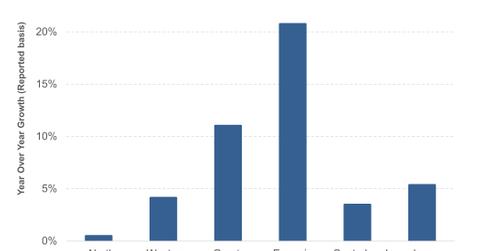

Inside Nike’s Double-Digit International Market Growth in Fiscal 2017

Nike’s key brand, Nike, which accounts for ~95% of the company’s business, saw a 7% YoY rise in its fiscal 4Q17 sales on a currency-neutral basis.

July 4 2017, Updated 10:38 a.m. ET

Nike brand sees strong international growth

Nike’s (NKE) key brand, Nike, which accounts for ~95% of the company’s business, saw a 7% YoY (year-over-year) rise in its fiscal 4Q17 sales on a currency-neutral basis. On a reported basis, sales rose 5%. For fiscal 2017, revenues grew 8% YoY on a constant currency basis and 6% on a reported basis.

“The Nike Brand delivered strong growth, demonstrating again the power of our uniquely diverse global portfolio,” noted Trevor Edwards, president of the Nike brand.

The key markets that drove the business were Western Europe, Greater China, and emerging markets—all of which posted double-digit growths in all four quarters of fiscal 2017. Apparel sales outpaced footwear throughout Europe, while footwear was stronger in Greater China and emerging markets.

North American sales grew 3% YoY, driven by strong growth in DTC (direct-to-customer) sales. Footwear sales rose 4%, while apparel fell 2%.

Sportswear and running

The sportswear and running categories were Nike’s best-performing categories, with both posting double-digit growth for fiscal 4Q17.

“We are seeing strong momentum in many iconic styles…from the Cortez to the Presto, and the success of the Air VaporMax, a high-performance running shoe is energizing the entire Nike Air platform,” Edwards announced.

DTC channel continues momentum

Nike’s DTC channel delivered another strong quarter. Sales rose 18% on a currency-neutral basis for fiscal 2017, driven by strong momentum in nike.com sales, which saw a 30% rise, in comps (comparable same-store sales), which saw growth of 7%, and in new store openings.

DTC revenues rose 12% in fiscal 4Q17. While DTC accounted for 35% of the company’s business for the quarter, it drove 70% of the top line.

Peer comparison

Like Nike, Under Armour’s (UAA) top-line growth was also led by a solid jump in international revenues at 55% and DTC sales at 13% in its recent most quarter.

Notably, ETF investors looking to add exposure to NKE can consider the SPDR Dow Jones Industrial Average ETF (DIA), which invests 1.8% of its total portfolio in NKE.