How Wall Street Analysts Rate Vornado Realty Trust

Analysts assigned VNO a mean price target of $108.18, which is 12.9% higher than its current price level.

July 11 2017, Updated 7:35 a.m. ET

Analyst ratings

Vornado Realty Trust’s (VNO) performance in the upcoming months of 2017 is reflected in its analyst ratings. Analysts assigned VNO a mean price target of $108.18, which is 12.9% higher than its current price level.

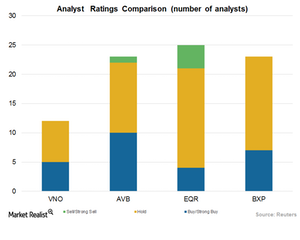

Currently, five of 12 analysts covering VNO stock issued “buy” or “strong buy” ratings. The remaining seven analysts gave it a “hold” rating. Vornado is disposing of its underperforming assets and concentrating on its core business.

The company has made a demographic shift of its properties to Class A cities, which helps it drive higher revenues. Markets with a high barrier to entry provide the company with a stable, premium customer base that it hopes could ensure a steady stream of revenues in the upcoming months.

These factors have made analysts bullish on the stock. However, the company’s debt-to-leverage ratio is skewed toward the higher side, which makes investors slightly cautious about the stock.

Compared to the ratings issued in March 2017, the number of VNO’s “strong buy” and “buy” ratings have remained at 7%.

Vornado’s peer ratings

Among Vornado Realty Trust’s (VNO) major peers, ten of 23 analysts gave AvalonBay Communities (AVB) a “buy” or “strong buy” rating. Twelve analysts gave AVB a “hold” rating, and one analyst gave the company a “sell” or “strong sell” rating.

Four of 25 analysts covering Equity Residential (EQR) gave the company a “buy” or “strong buy” rating. While 17 analysts rating EQR assigned it a “hold” rating, four analysts gave it a “sell” or “strong sell” rating.

Seven of 23 analysts covering Boston Properties (BXP) gave it a “buy” or “strong buy” rating. Sixteen analysts gave BXP a “hold” rating. No analysts gave the stock a “sell” or strong sell” rating.

Vornado, Boston Properties, and Equity Residential make up ~12.4% of the iShares Cohen & Steers REIT ETF (ICF). ICF’s portfolio is broadly diversified in terms of geography as well as product offerings, which provides a cushion against industrial and macroeconomic headwinds and volatility.