How Vornado’s Revenue Could Benefit from Strategic Initiatives

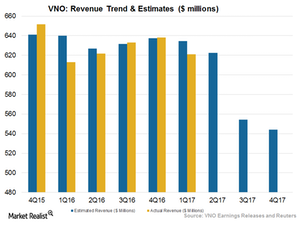

Analysts expect Vornado Realty Trust (VNO) to report revenues of $622.3 million for 2Q17 when it releases its earnings on July 31, 2017.

July 25 2017, Updated 4:06 p.m. ET

Expected top line in 2Q17

Analysts expect Vornado Realty Trust (VNO) to report revenues of $622.3 million for 2Q17 when it releases its earnings on July 31, 2017. Revenue is expected to be down 0.4% year-over-year as the higher occupancy in its properties is expected to be offset by the near-term headwind of dilution of revenue due to the disposition of a number of its assets.

Vornado, however, is expected to overcome the short-term headwind with the help of its strategic initiatives of development and redevelopment of its existing properties. The company is expected to report a revenue of $2.3 billion for 2017, up 4% year-over-year.

Location plays a key role in revenue growth

Last week, Vornado completed the tax-free spin-off of its JBG Smith business in Washington, D.C. The disposition is in line with its target to concentrate solely on its New York business. VNO is trying to concentrate on its revenue-driving core properties with locational advantages. The spin-off has transformed the company into a New-York-based company with properties located only in Class A cities.

Drivers of revenue growth in 2Q17

VNO’s New York retail business leased 12,400 square feet in five deals during 1Q17. Further, the company started the second quarter on a strong note. It was successful in leasing 10,000 square feet to Amazon for a bookstore at its 3040 M Street, Georgetown property.

Further, it leased out 552,700 square feet of office space in New York. The company leased out 100,300 square feet at The Mart and 66,300 square feet at 55 California Street. These expansion activities are expected to create additional synergies in 2Q17.

A bright beginning to the year

In 1Q17, Vornado’s revenues of $620.9 million missed analyst estimates by 2.2%. However, the results came in 1.3% higher than in the corresponding period last year.

Other peers in the same industry like AvalonBay Communities (AVB), Boston Properties (BXP), and Equity Residential (EQR) are expected to report revenues of $529.1 million, $639.5 million, and $608.6 million, respectively.

Vornado and its residential REIT peers together constitute 12.4% of the iShares Cohen & Steers REIT ETF (ICF). ICF’s wide product diversity helps investors cushion against macro headwinds.