How Does Wall Street Rate Essex Property Trust?

Essex Property Trust’s (ESS) performance expectations in 2017 are reflected in analysts’ ratings for its stock. Analysts have given ESS a mean price target of $257.6.

July 12 2017, Updated 9:06 a.m. ET

Analysts’ ratings

Essex Property Trust’s (ESS) performance expectations in 2017 are reflected in analysts’ ratings for its stock. Analysts have given ESS a mean price target of $257.6, implying a potential rise of 1% from its current level of $255.5.

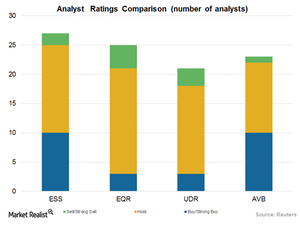

Currently, ten of the 27 analysts covering ESS have issued “buy” or “strong buy” ratings on the stock. The remaining 15 analysts have given it “hold” ratings, and two analysts have given it “sell” or “strong sell” ratings. The company’s presence in the residential and office property industry is favorable for it in the present economic scenario, in which there’s steady growth in the job market coupled with stable rent growth. Moreover, Essex’s strategy of concentrating its properties in Class A high-demand cities has made analysts bullish on its stock.

A peer comparison

Among Essex Property’s major peers, three of 25 analysts have given Equity Residential (EQR) “buy” or “strong buy” ratings. Eighteen analysts have given EQR “hold” ratings, and four analysts have given it “sell” or “strong sell” ratings.

Three of the 21 analysts covering UDR (UDR) have given the company “buy” or “strong buy” ratings. Fifteen analysts have given it “hold” ratings, and three have given it “sell” or “strong sell” ratings.

Ten of the 23 analysts covering AvalonBay Communities (AVB) have given it “buy” or “strong buy” ratings. Twelve analysts have given AVB “hold” ratings, and one analyst has given it a “sell” or a “strong sell” rating.

The iShares Residential Real Estate Capped ETF (REZ), which holds a combined total of ~20% in AvalonBay, Equity Residential, and Essex Property, has a market cap–weighted index with a wide product portfolio covering industries such as healthcare, self-storage, and residential real estate investment trusts. Investors looking to stay risk-averse can look to REZ, which provides a cushion against volatility.