How Analysts View Public Storage

Analysts have assigned PSA a mean price target of $217.67, which is 4.9% higher than its current price level.

July 26 2017, Updated 9:06 a.m. ET

Analyst ratings

Public Storage’s (PSA) 2Q17 expected performance is reflected in its analyst ratings. Analysts have assigned PSA a mean price target of $217.67, which is 4.9% higher than its current price level.

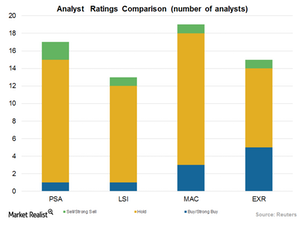

Currently, only one of the 17 analysts covering PSA stock has issued a “buy” or “strong buy” rating. The remaining 14 analysts have given PSA a “hold” rating. Two analysts have assigned a “sell” or a “strong sell” rating. The number of PSA’s “strong buy” and “buy” ratings has remained the same since April 2017.

The strategic locations of Public Storage facilities and its sales-boosting initiatives appear to have made analysts bullish on the stock.

Peer ratings

One of the 13 analysts covering Life Storage (LSI) gave the stock a “buy” or “strong buy” rating. Eleven analysts assigned LSI a “hold” rating, and one analyst assigned it a “sell” or a “strong sell” rating.

Five of the 15 analysts covering Extra Space Storage (EXR) gave the stock a “buy” or “strong buy” rating. Nine analysts gave it a “hold” rating, and one analyst assigned it a “sell” or a “strong sell” rating.

Three of the 19 analysts covering Macerich (MAC) gave the stock a “buy” or “strong buy” rating. Fifteen analysts gave MAC a “hold” rating, and one analyst assigned a “sell” or a “strong sell” rating to the stock.

Public Storage and Extra Space together make up ~9% of the iShares Cohen & Steers REIT ETF (ICF).