Asian Markets Pulled Back on July 28

On July 28, the Shanghai Composite Index rose 0.11% and ended the day at 3,253.24. The SPDR S&P China ETF (GXC) fell 0.48% to $95.76 on July 27.

July 28 2017, Published 10:10 a.m. ET

Economic calendar

8:30 AM EST – U.S. Employment Cost Index (Q2)

8:30 AM EST – US GDP (Q2)

10:00 AM EST – US Michigan Consumer Expectations (July)

1:00 PM EST – US Baker Hughes Oil Rig Count

1:20 PM EST – FOMC member Kashkari speaks

China

After rising for five consecutive trading weeks, China’s Shanghai Composite Index started this week on a positive note. On Monday, it rose to more than a three-month high. Despite losing momentum on Tuesday amid profit-booking, especially in blue-chip stocks, the Shanghai Composite Index has been trading with strength at three-month high price levels this week.

On Friday, the Shanghai Composite Index started the day lower but regained strength and ended the day with gains. Increased buying in the resource sector amid the government’s supply-side reforms supported the market on Friday. By gaining on Friday, the Shanghai Composite Index recorded the sixth consecutive profitable trading week. Recently, stronger-than-expected economic data and increased optimism about China’s economic stability in 2H17 were the main drivers that moved China’s markets higher.

On July 28, the Shanghai Composite Index rose 0.11% and ended the day at 3,253.24. The SPDR S&P China ETF (GXC) fell 0.48% to $95.76 on July 27.

Hong Kong

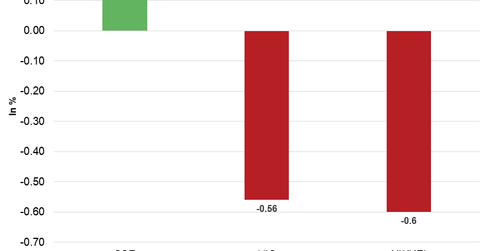

Hong Kong’s Hang Seng Index gained for two consecutive trading weeks and rose to two-year high price levels. With improved sentiment, the Hang Seng Index started this week by rising on Monday. After gaining for the first four trading days of the week, the Hang Seng Index pulled back on Friday amid profit-booking but ended the week with gains. The pull back of Tencent, AIA along with profit-booking at more than two-year high price levels weighed on the Hang Seng Index on July 28. It fell 0.56% and closed the day at 26,979.39. The iShares MSCI Hong Kong ETF (EWH) fell 0.12% to $24.06 on July 27.

Japan

After closing flat last week, Japan’s Nikkei Index started this week on a mixed note. Despite stronger-than-expected household spending and Tokyo Core CPI data released after market hours on Thursday, Nikkei opened lower on Friday. The stronger yen along with weakness in the shipbuilding and paper and pulp sectors weighed on the market. Nikkei fell 0.6% and closed the day at 19,959.84.

In the next part, we’ll discuss how European markets performed in the morning session on July 28.