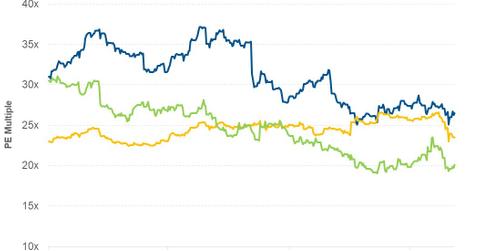

Domino’s Valuation Multiple Compared to Its Peers

As of February 14, 2018, Domino’s was trading at a forward PE multiple of 26.5x compared to 31.8% before the announcement of its 3Q17 earnings.

Feb. 16 2018, Updated 7:33 a.m. ET

Valuation multiple

Valuation multiples help investors compare companies that have similar business models. Due to the high visibility of Domino’s Pizza’s (DPZ) earnings, we’ve opted to use the forward PE (price-to-earnings) multiple. A forward PE multiple is calculated by dividing a company’s stock price by analysts’ earnings estimate for the next four quarters.

Domino’s forward PE multiple

As of February 14, 2018, Domino’s was trading at a forward PE multiple of 26.5x compared to 31.8% before the announcement of its 3Q17 earnings. Although the stock has increased 0.3% since the announcement of its 3Q17 earnings, Domino’s valuation multiple has declined due to analysts’ higher EPS (earnings per share) estimates for the next four quarters.

From the above graph, you can see that Domino’s is trading at a higher valuation multiple than its peers. On February 14, its peers Papa John’s (PZZA) and Yum! Brands (YUM) were trading at 20.1x and 23.5x, respectively. Strong same-store sales growth and growth in earnings have allowed Domino’s Pizza to trade at a higher valuation multiple.

Growth prospects

For the next four quarters, analysts are expecting Domino’s EPS to rise 37%, which could have been factored into the company’s current stock price. If the company fails to post earnings in line with analysts’ estimates, selling pressure could bring down the stock price and the company’s valuation multiple.

Next, let’s look at analysts’ recommendations for Domino’s Pizza for 4Q17.