2Q17 Performances for VF’s North Face, Vans, and Timberland

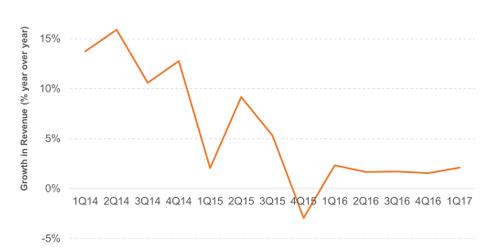

VF’s Outdoor & Action Sports segment, which focuses on Vans, North Face, and Timberland, recorded a 4.0% YoY rise in sales to $1.5 billion.

July 27 2017, Updated 7:44 a.m. ET

North Face has a solid quarter

In this part of the series, we’ll look at the performance of VF Corporation’s (VFC) largest business segment: Outdoor & Action Sports.

The Outdoor & Action Sports segment, which mainly focuses on the Vans, North Face, and Timberland brands, recorded a 4.0% YoY (year-over-year) rise in sales to $1.5 billion.

Let’s start with the performance of North Face. Revenues for the brand rose 6.0% YoY during the quarter, driven by a 26.0% growth in Europe and a 1.0% rise in both Asia and America. Its direct-to-consumer (or DTC) business expanded at a mid-teen rate, while wholesale remained flat.

Growth in America was driven by a mid-teen growth in the DTC business. The digital channel was particularly strong and recorded a 40.0% rise in sales during the quarter. However, a weakness in wholesale, primarily due to the impact of bankruptcies, washed away most of the gains in the region.

In Europe, both wholesale and DTC showed strong momentum in the high single-digit range. The wholesale business rose nearly 40.0%.

DTC for Vans delivers stellar performance

Vans, which is VFC’s fastest-growing brand, recorded a 9.0% rise in global revenues. Sales were driven by a solid performance in all geographies, mainly through the DTC channel. Sales rose 7.0% in the Americas, 5.0% in Europe, and 29.0% in Asia.

DTC channel sales recorded a 25.0% rise in sales. The wholesale business, however, fell at a low single-digit rate during the quarter.

Timberland returns to growth

Timberland returned to growth during the quarter. Global revenue rose 3.0%, driven by a mid-single-digit growth in D2C and a low single-digit rise in the wholesale business.

Investors who want exposure to VFC can consider the PowerShares High Yield Equity Dividend Achievers ETF (PEY), which invests 1.7% of its portfolio in VFC.

In the next part of this series, we’ll look at the performance of VF’s other businesses.