Where Crown Castle Stands among the Biggest Industry Players

CCI’s higher price-to-FFO multiple reflects the company’s ability to yield consistent capital value and its distribution of reliable and steady dividends.

June 30 2017, Updated 10:35 a.m. ET

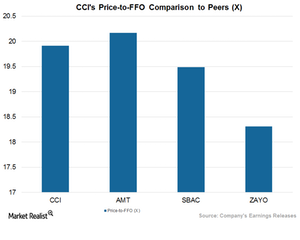

Price-to-FFO multiple

The price-to-FFO (funds from operation) is the most effective way to measure the relative value of REITs (real estate investment trusts) like Crown Castle International (CCI). An REIT’s price-to-FFO multiple is similar to the PE (price-to-earnings) ratio used to calculate the relative value of companies in other industries.

Peer group price-to-FFO multiples

CCI’s current price-to-FFO multiple is 19.91x. CCI’s higher price-to-FFO multiple reflects the company’s ability to yield consistent capital value and its distribution of reliable and steady dividends to investors.

CCI has recently embarked upon several acquisitions and strategic partnerships to boost its presence in the futuristic 5G spectrum band and small cell networks. It has also raised its funds from operations and revenue guidance for fiscal 2017. These actions may have triggered the spike in its share price as well.

According to its price-to-FFO multiple, CCI is trading on par with most of its peers. While American Tower (AMT) is trading at a price-to-FFO multiple of 20.17x, SBA Communications (SBAC) and Zayo Group Holdings (ZAYO) are both trading at 19.49x.

Peer group dividend yield

Crown Castle is now offering a next-12-month dividend yield of 3.8%, as compared to American Tower’s dividend yield of 1.9%, Century Link’s (CTL) 8.8%, and Verizon Communications’ (VZ) 5.1%.

NAV (net asset value) is also a method of valuation for REITs. American Tower and Crown Castle make up 11.5% of the PowerShares Active US Real Estate ETF (PSR), which has an NAV of $79.61.

In the next and final article in this series, we’ll look at how the analysts see Crown Castle.