What NVIDIA’s Cash Position Says about Its Financial Health

NVIDIA’s operating cash flow fell 8.7% year-over-year to $282 million in fiscal 1Q18 as its revenues were hit by seasonal weakness. Its accounts receivables increased 87% YoY.

June 21 2017, Updated 9:05 a.m. ET

NVIDIA’s revenues and cash flow

In the earlier few parts of this series, we saw that NVIDIA (NVDA) is witnessing strong double-digit growth in its Gaming and Automotive segments and triple-digit growth in its Data Center segment.

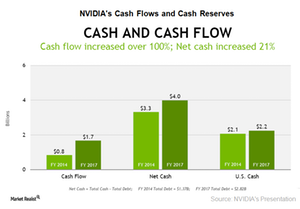

The high margins in Automotive and Data Center have significantly increased the company’s operating profit and doubled its cash flow over the past four years. As long as the company’s revenues grow, its cash flow would also grow.

Cash flow

NVIDIA’s (NVDA) operating cash flow fell 8.7% YoY (year-over-year) to $282 million in fiscal 1Q18 as its revenues were hit by seasonal weakness. Its accounts receivables increased 87% YoY. Rival Advanced Micro Devices (AMD) posted operating cash flow of -$299 million during the same quarter as it struggles to return to profitability.

Over the past four years, NVIDIA’s operating cash flow has more than doubled from $824 million in fiscal 2014 to $1.7 billion in fiscal 2017, driven by strong revenues and operating margins. As high-margin data center and advanced gaming GPUs (graphics processing units) increase their contribution to the overall revenues, the company’s cash flow would increase significantly.

Shareholder returns

NVIDIA (NVDA) is a growth stock that has recently started seeing strong growth. Hence, the company increased its dividend per share from $0.12 in fiscal 2Q16 to $0.14 in fiscal 3Q16. In fiscal 1Q18,[1. fiscal 1Q18 ended April 29, 2017] the company paid $82 million in dividends.

NVIDIA started paying a dividend in fiscal 2013. Since then, it has returned 85% of its free cash flow, or $4 billion, to shareholders through dividends and share buybacks. It plans to return ~$1.3 billion to shareholders in fiscal 2018.

On the other hand, mature stocks like Qualcomm (QCOM) are increasing their dividends even when earnings are falling.

Cash and debt

In fiscal 1Q18, NVIDIA’s (NVDA) cash reserves fell ~$600 million to $6.2 billion as it paid the principal on convertible notes that were exercised earlier. Its long-term debt stood at $2.0 billion, resulting in a net cash position of $4.2 billion. On the other hand, Intel (INTC) and AMD have net debt positions.

High cash flows and cash reserves have put NVIDIA in a strong financial position to withstand short-term headwinds and invest in future growth opportunities. The company is funding several AI (artificial intelligence) startups to promote the adoption of AI.

NVIDIA’s high cash flows and strong earnings growth have made analysts bullish about the company. We’ll look into this in the next part of this series.