What Drove Pfizer in 1Q17?

Growth drivers for Pfizer (PFE) include products contributing to operational growth, such as BMP2, Celebrex, Ibrance, Lyrica, and Xeljanz.

June 8 2017, Updated 9:06 a.m. ET

Growth drivers

Growth drivers for Pfizer (PFE) include products that are contributing to the company’s operational growth. These products include Innovative Health segment products like BMP2, Celebrex, Ibrance, Lyrica, and Xeljanz.

Products with positive growth drivers

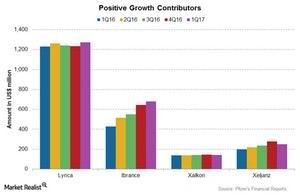

Lyrica, an anticonvulsant drug, reported revenues of ~$1.3 billion, representing a 3% growth in its 1Q16 revenues. Lyrica revenues are classified in the Innovative Health and Essential Health segments as Lyrica IH and Lyrica EH, respectively.

Lyrica EH includes revenues from Europe, Russia, Israel, Central Asia, and Turkey, while Lyrica IH represents revenues from rest of the world. During 1Q17, the 35% fall in Lyrica EH revenues was more than offset by the 12% rise in Lyrica IH revenues.

Ibrance, a drug for the treatment of advanced breast cancer, reported a growth of ~59% to $679 million in its 1Q17 revenues, as compared to $429 million in 1Q16, following the strong response from healthcare practitioners in the US. Ibrance sales in the US totaled ~$608 million in 1Q17, as compared to $422 million in 1Q16.

Other key product updates

Below is a breakdown of several other PFE drugs, based on recent updates:

- Celebrex, a non-steroidal anti-inflammatory drug for pain management, reported an increase of 2% in its 1Q17 revenues to $175 million, as compared to in 1Q16.

- Chantix-Champix reported a 9% growth in 1Q17 revenues to $239 million, as compared to 1Q16.

- Xalkori reported a growth of 2% in its 1Q17 revenues to $142 million, while Xeljanz reported a growth of ~27% in its 1Q17 revenues to $250 million.

- BMP2 reported a growth of 21% in its revenues at $62 million during 1Q17, due to increased demand in US markets.

- Medrol, a sterile injectable product, reported a 6% growth in revenues to $120 million during 1Q17.

- Sulperazon reported a 27% growth in revenues, reaching $122 million in 1Q17.

Notably, Alliance revenues reported an 82% growth to $656 million in 1Q17, as compared to $360 million in 1Q16. Alliance revenues included Eliques and Rebif in 2015 and Eliques and Xtandi in 2016.

To divest company-specific risk, investors can consider ETFs like the VanEck Vectors Pharmaceuticals ETF (PPH), which has 6.8% of its total assets in Pfizer. PPH also holds 4.9% of its total assets in Sanofi (SNY), 5.1% in GlaxoSmithKline (GSK), and 4.7% in Abbott Laboratories (ABT).