Soros: Why Brexit Could Lead to Lower Living Standards

Lower trade and investment flows could impact employment and wage growth, which might impact the standard of living in the United Kingdom.

June 26 2017, Updated 10:37 a.m. ET

George Soros discussed Brexit

After Britain’s (EWU) exit from the European Union (FEZ) (HEDJ), billionaire investor George Soros said that it might spark disintegration in the European Union (VGK).

The global market showed huge nervousness immediately after the event. Investors expected that it might trigger other member countries to follow the same path. Soros thinks that among the European Union’s various members, the United Kingdom had an excellent trade deal with the European Union. The United Kingdom could use its own currency in the European Union’s common market.

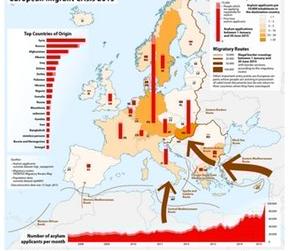

However, the United Kingdom opted to leave the European Union (IEV) due to free migration and the poor refugee policy. The United Kingdom’s citizens think that free migration among the European Union’s member countries impacted employment. A series of terror attacks in various European Union countries strengthen Britain’s desire to leave the European Union.

Since the United Kingdom already decided to exit the European Union, it won’t have access to the European Union’s common market. It won’t get the benefit of fewer trade barriers, which the European Union provides to its member countries. Trade flow and investment flow are also expected to be reduced drastically in the United Kingdom, which could impact the demand outlook for various businesses. Lower trade and investment flows could impact employment and wage growth. If wage growth is lower, it might impact the standard of living in the United Kingdom.