Is LyondellBasell Managing Its Interest Expenses Efficiently?

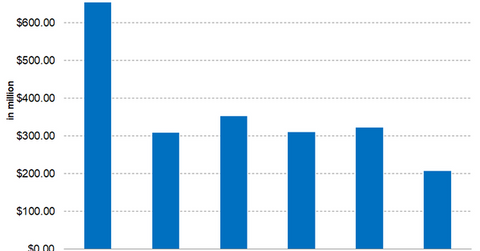

LyondellBasell’s (LYB) interest expense has been steady in the range of $309 million–$352 million since 2013, although debt has risen during the same period.

June 28 2017, Updated 12:35 p.m. ET

LyondellBasell’s interest expense

It’s interesting to note that LyondellBasell’s (LYB) interest expense has been steady in the range of $309 million–$352 million since 2013, although debt has risen during the same period. The major reason for the steady interest expense is due to LYB’s ability to replace its higher coupon debt with lower coupon debt. LYB incurred $294 million in expenses in 2012 to refinance its notes that carried higher coupon rates of 8% and 11% with lower interest rates. As a result, the interest expense in 2012 stood at $655 million.

In February 2017, LYB exercised a similar action and refinanced its $1 billion note carrying a 5% coupon rate with a 3.5% coupon rate. LYB incurred charges of $113 million on this transaction, resulting in higher interest expenses in 1Q17. LYB recorded $207 million in interest expenses for 1Q17. However, the refinancing of notes with lower coupon rates will help to reduce its interest expense and eventually have a positive impact on earnings.

LyondellBasell’s interest coverage ratio

The interest coverage ratio indicates how well a company can service its debt. It can be obtained by dividing EBIT (earnings before interest and taxes) by interest expense. The higher the multiple, the better it is for the company. At the end of 1Q17, LYB’s interest coverage ratio stood at 5.80x. However, if you exclude the one-time charge of $113 million towards refinancing, LYB’s interest coverage ratio stands at 12.90x. This figure indicates that LYB can easily service its debt.

Investors can indirectly hold LYB by investing in the Vanguard Materials ETF (VAW), which invests 3.3% of its portfolio in LYB. The top holdings of the fund include Dow Chemical (DOW), DuPont (DD), and Monsanto (MON), which have weights of 9.1%, 8.3%, and 6.1%, respectively, as of June 26, 2017.

In the next part, we’ll look into LYB’s latest analyst recommendations.