How Wall Street Analysts View AvalonBay Stock

In May 2017, 11 of 23 analysts covering AVB stock issued “buy” or “strong buy” ratings.

June 19 2017, Updated 7:35 a.m. ET

Analyst ratings

AvalonBay Communities’ performance expectations in 2017 are reflected in its analyst ratings. Analysts gave AVB a mean price target of $197.30, implying a rise of 3.2% from its current level of $191.24.

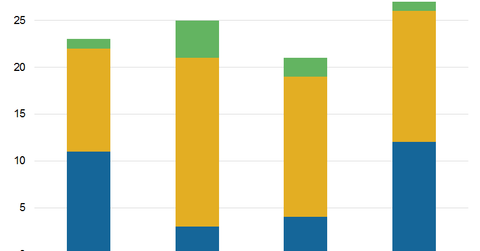

In May 2017, 11 of 23 analysts covering AvalonBay Communities (AVB) stock issued “buy” or “strong buy” ratings. Eleven analysts gave AVB a “hold” rating, and one analyst gave it a “sell” or a “strong sell” rating. Compared to the ratings issued in December 2016, the number of AVB’s “strong buy” and “buy” ratings fell from 12 to 11.

AVB’s peer ratings

Among AvalonBay Communities’ (AVB) major peers, three of 25 analysts gave Equity Residential (EQR) a “buy” or “strong buy” rating. Eighteen analysts gave EQR a “hold” rating, and four analysts gave it a “sell” or a “strong sell” rating.

Four of 21 analysts covering UDR Inc. (UDR) gave the company a “buy” or “strong buy” rating. Fifteen analysts gave it a “hold” rating, and two analysts gave it a “sell” or “strong sell” rating.

Twelve of 27 analysts covering Essex Property (ESS) gave it a “buy” or “strong buy” rating. Fourteen analysts gave ESS a “hold” rating, and one analyst gave it a “sell” or a “strong sell” rating.

AvalonBay constitutes 9% of the iShares Trust – iShares Residential Real Estate Capped ETF (REZ). The ETF has a market cap–weighted index that covers wide variety of industries like healthcare, self-storage, and residential REITs.