How Wall Street Analysts Rate American Tower

Analysts gave AMT a mean price target of $143.14, implying a rise of 8.7% from its current level of $131.70. In May 2017, 22 of 23 analysts covering AMT stock issued “buy” or “strong buy” ratings.

June 15 2017, Updated 7:35 a.m. ET

Analyst ratings

American Tower Corporation’s (AMT) performance expectations in 2017 are reflected in its analyst ratings. Analysts gave AMT a mean price target of $143.14, implying a rise of 8.7% from its current level of $131.70.

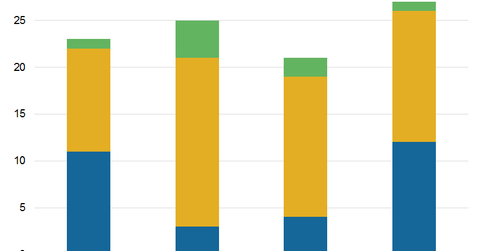

In May 2017, 22 of 23 analysts covering AMT stock issued “buy” or “strong buy” ratings. The one remaining analyst gave AMT a “hold” rating. Compared to the ratings issued in December 2016, the number of AMT’s “strong buy” and “buy” ratings rose from 21 to 22.

AMT’s peer ratings

Among American Tower’s (AMT) major peers, 16 of 22 analysts gave Crown Castle International (CCI) a “buy” or “strong buy” rating. Six analysts gave AMT a “hold” rating.

Four of 19 analysts covering Realty Income (O) gave the company a “buy” or “strong buy” rating. Ten analysts gave it a “hold” rating. Five analysts gave it a “sell” or “strong sell” rating.

Sixteen of 22 analysts covering Simon Property Group gave it a “buy” or “strong buy” rating. Six analysts gave SPG a “hold” rating.

American Tower, which competes with SBA Communications (SBAC), comprises 7% of the PowerShares Active US Real Estate ETF (PSR). PSR has a market cap–weighted index that covers specialized, residential, and commercial REITs.